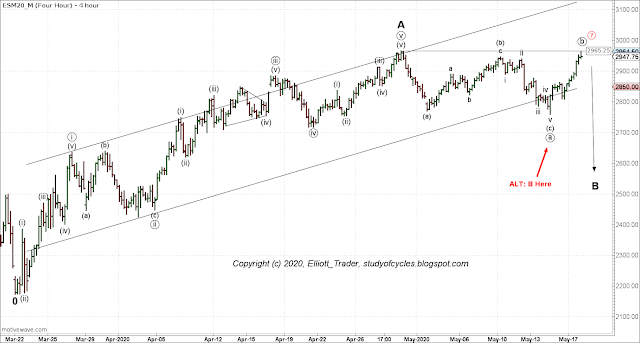

From the flat for the three-wave minute ((a)) wave in the lower left, you can see that this wave has been traveling upwards in the 'half-channel' provided by the parallel shown. You can see that the count already has a problem with overlap at the red line across (w) labeled with "Already Overlapped".

|

| ES Futures - 2 HR - Half Channel Count |

On Friday we discussed that the most recent down wave, currently labeled as the second (x) in the series is longer in nominal length than the whole of the prior (x) wave. We said on Friday that could mean a "turn of degree" was at hand. We also said on Friday that one way to rectify that potential degree violation is with a triangle. I do not know if a triangle will form, but it should be watched for. All it needs to do in Sunday's overnight is for an e wave to travel back down over the (y) wave.

Don't like this count? Well, there is another internal problem I ran into with the time parameter. If you look at the absolute number of bars in (y), you find that it is greater than the number in (w). That means that (y) and (w) 'must' be of the same degree or (y) must be of a larger degree. Further, that means there 'must' be a sub-division within (y) that I have showed as black a, b. I have showed one location for a that is less than the number of bars in (w), but you could also move it down one peak, and b could be another flat within (y).

Again, I don't know if a triangle will form, but if a triangle does form, it also has the potential to be the triangle just before that last wave up. But, let me be clear, a triangle does not have to form. It is possible that the net distance traveled in a flat wave to the current (x) location resolves the degree issue, as the net distance traveled is less than the point drop in the whole of the first (x).

Again, the Elliott Wave Oscillator continues declining and does not look like an impulse signature on this time scale.

Something to chew on over the weekend. Enjoy it. This is the second post this weekend, and if you have not seen it, you may wish to read the first one, also.

TraderJoe