Market Indexes: Major U.S. Equity Indexes closed higher; DJUtil lower

SPX Candle: Higher High, Higher Low, Higher Close - Trend Candle

FED Posture: Quantitative Tightening (QT)

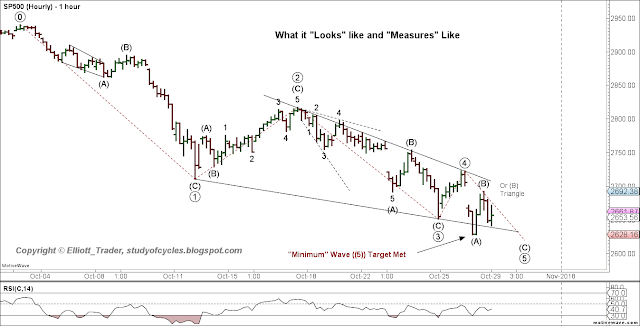

Yesterday, we said the scenario for how we would make "five waves up" was uncertain. We saw a potential leading diagonal and a gap up scenario. The gap up is what played out. Prices as measured by the S&P500 Cash Index closed yesterday at 2,683. They gapped up to open at 2,706 (a +26 point gap), and continued traveling upward to 2,737. All day long, until near the close, the buy programs provided the 'treat' some were looking for. In the process the waves up yesterday made a 1.618 extension in the futures - a bit too far for a typical (b) wave, and more like a third wave. In cash, the extension was a 1.27 extension. Still good enough. In the process wave ((4)) of the hourly diagonal was exceeded higher, and with it the hourly down trend line.

Then, as if like clock work, at 15:00 ET late day sell programs played their 'trick' and dropped the market down to gap support, back to 2,710 a decline of -27 points from the high.

Again on a one time basis, so you have some confidence, here is today's five minute cash chart for your review. Included are yesterday's waves.

|

| S&P500 Cash Index - 5 Minutes - Channel |

Currently, we have four waves up in a channel that follows The Eight Fold Path methodology quite well. We do not know that the fourth wave is done - could still go a bit lower. But, there is good alternation between wave ((2)) as a clear 5-3-5 zigzag - with its lower (B) wave, and wave ((4)) as a 3-3-5 flat, with its higher (B) wave.

Remember, on the wave ((3)) up count, due to degree labeling requirements, no sub-wave within ((3)) may be longer than ((1)), and the sub-waves are so labeled. They fit well, and wave (3) of ((3)) is on the peak of the EWO, and is the wave with the gap in it.

The day's down trend did not begin until a tiny little ending diagonal C wave of the (B) wave overall had it's fifth wave ((v)) fail by just a bit. Awww ..

For this up wave to remain an impulse, then wave ((1)) may not be overlapped. So far, so good. We'll see what tomorrow brings. From the standpoint of "window dressing" they lifted the market early so they could easily sell their losers into the higher prices, and then dropped it to begin to pick up their preferred names . You never know how these things are going to go.

Have a good night and stay out of mischief on a night like tonight - Boo!

TraderJoe