Foreword: nothing in this study alters my current count. In fact, portions of it reinforce the count, as far as it is taken to this point.

Long-time readers of this blog have seen me call out how the ES futures can be down -20 or -30 points in the overnight, only to have the cash market open and to see all of those overnight declines simply vanished or erased from the cash market prints. Here is a study in the opposite direction.

First, looking at the SPY 15-min cash index on the day of Wednesday February 15th, we see that the day may be counted as a diagonal wave. The wave lengths are correct, with ((5)) < ((3)) < ((1)), and ((4)) < ((2), with wave ((4)) overlapping wave ((1)).

Overnight has a significant gap down, and the "start of the diagonal is taken out in less time than the diagonal took to form". IF this is a true ending diagonal, then it is significant, and so far, it has been partly responsible for a larger downward wave, including another gap down from the 16th to the 17th.

Now let's look at the futures, including the overnight futures, on the day of the 15th and into the 16th. Here is the chart of the ES 15-min during that period.

Now, you can see where the cash session ended at 16:00 ET - at the beginning of the pink square. And what do you notice? There are several additional local highs, taking the futures print from ~4,160 to near ~4,170 at 3 AM. Then, there is a drip, drip, drip lower in the low volume until the 08:30 ET bar on the 16th - which is, of course, the news bar which delivered the economic news of the morning.

So, what is going on here?

Well. What else do we know? We know - almost for certain - that due to the sleep cycle - the vast majority of traders in the U.S. money centers (NY, Boston, Atlanta, Miami, Chicago, Dallas) are fast asleep. Yet, someone, or something created these extra waves. It did happen. The waves are in the market. And, yes, we know that Asia & London may begin more active trading as the New York market is still sleeping.

Now, here is an assumption. The assumption is that the CME's price algorithm is in control of pricing. Regardless of, or maybe because of, the low overnight volume, nothing is going to happen without the CME market-making algorithm, or perhaps those large companies (Goldman Sachs, Blackrock, GTS, etc.) that are allowed to make markets and their algorithms operating in the market. And, regardless of the specific market-making-program, or who owns it, someone is monitoring overnight markets to ensure that there are no untoward developments (war, asteroid, earthquake, hedge-fund blow up, etc.).

Now clearly, whomever this someone is, they are working third-shift versus the eastern time zone. You are asleep. They are working third-shift. Did you ever work third-shift? Many people haven't. They aren't aware or don't fully appreciate that there is a whole minor economy operating between midnight and 8 AM. OK. But what are these people doing?

If they were like me, when I worked third shift, they are doing just what you'd expect. They are acting on behalf of their employers and largely doing what their employer requests - as long as it isn't illegal. But what are they specifically doing?

Let's just suppose that the night trading desk manager (DM) is as versed in Elliott Wave as you or I am. Why not? It's not that hard. The DM says, "oh my gosh, there's a valid diagonal in the cash market. Probably a lot of traders and institutional analysts recognize it." So, what are the DM's instructions to the rest of the trading desk or the algorithms? "Bust it! Just bust it! Do whatever you need to leave the market on 'five-up' still but don't go over the prior daily high until we know more."

So, they take it up in an after-hours grind trying to bust the stops. They take it up +10 points, and depending on some trader's leverage, they run at least some of the stops. Why? Because the further upward prices leave cash-session traders scratching their heads saying, "wait: after a diagonal, prices should be going down from here. Not up. This is not at all what we expected."

Yet, they leave the market on "five-up". They take all the time in the world, which creates more frustration for traders. They don't go over the prior high, and then, they head down when everyone else is fast asleep. No competition - or less competition anyway.

Is this insidious? Yes. Is it manipulative? Well, that depends on your point of view. If you're a dumb-money retail trader, it seems unfair & manipulative. But it certainly is legal. Money-center traders are allowed by regulation to make a profit. In fact, you are allowing them to do this by the laws you allow to exist on the books. The really discouraging thing would be if your own broker is participating, allowing, or even encouraging such behavior.

For now, without a "Retail Trader's Group" or some sufficient numbers to try to encourage reform, it will definitely continue to go on. It's too profitable for them. And further, doing something different would require 'a different paradigm' of fairness between retail traders and market-makers, and that paradigm does not exist yet - that I am aware of.

So, what can be done about this? What's the reason for the post? Well, the first thing you can do is to be actively aware of the phenomenon. Ira Epstein refers to the phenomenon as the "ying-yang" effect, as the trade from active news reports is reacted to where the sun is rising next.

The second thing one might do is to try working some third shifts. See if you can spot them 'doing it' in real time. If so, you might spare yourself some aggravation. Third, if you can't work the overnight, you might actively study the overnight charts to see what patterns were made prior to the cash opening to see if your wave count still makes some sense.

If you're an ETF trader, you might care a little less because there is less after-hours trading in ETF's although there is still some. And, if you trade futures, you might care a little bit more because it can impact your trading style. But regardless of what type of trader you are, you should likely care about the issue of who are the market players - and which are allowed to have just how much advantage over the others. Is it really meant that there will always be large money players that can steam-roll over other traders? And, if not, how can it be corrected. Think it through.

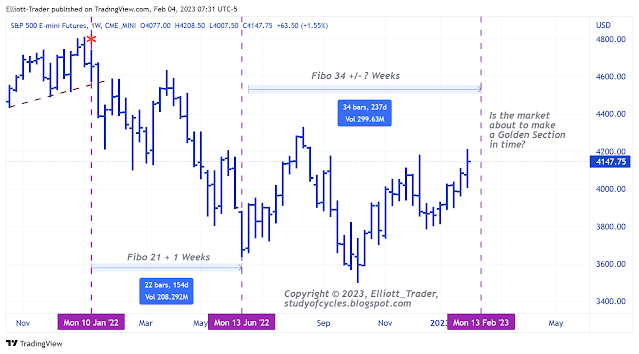

This is the second post this weekend, and the local EW count appears in the first one if you are interested.

Have an excellent rest of the weekend.

TraderJoe