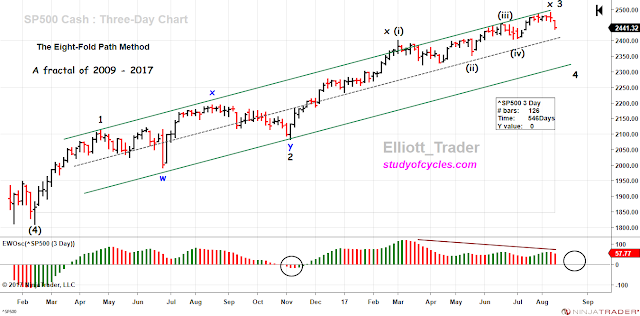

Since we have presented our overall market views quite clearly over the last several weeks and months, we thought we would take a moment to present an educational post which is relevant to the present. There are any number of people who are interested in the Russell 2000 Index. And this week something has happened which is fairly rare, but still a part of Elliott Wave analysis, overall. Many, many people don't like to deal with complication and the rules like this, but my hope is that through repeated exposure, one might gain more comfort with some of the basic Elliott Wave patterns.

So, without further delay, here is the hourly chart of the Russell 2000 E-Mini Futures since the low on August 21. We hope you will study this pattern, and read this entire post in detail.

Perfect Diagonal

|

| Russell 2000 E-Mini Futures - Hourly |

This contracting pattern upward, is easier to discern for trained eyes, but we think that many beginning wave counters might have a problem with the details. This pattern looks, and counts, like a perfect contracting diagonal.

If you take the measurements, you'll find that wave (5) is shorter than wave (3), wave (3) is shorter than wave (1), wave (4) is shorter than wave (2), wave (4) overlaps wave (1), downward, and each of the waves can be parsed into three-wave zigzags. And that's where the fun begins.

We think the hard section for most wave counters would be the "running triangle"

b wave within the wave (3), upward. A triangle somewhere in the middle of a diagonal is actually quite common. It causes the novice analyst to think that wave (3) is over at

(b) - which is not an unreasonable thought - until the downward pattern starts to develop at (4), but doesn't show the rapid price drop expected after a completed diagonal.

Another difficult part is that sharp

(e) wave drop as the last wave in the triangle, but it does not violate the

(c) wave low of the triangle - just as required in a running triangle.

Something else that is quite common. Note how wave (5) just peeks over the top of the upper rising diagonal trend line in a very characteristic throw-over. It is incredible to see that tiny detail.

Well, if that were the end of the story, then it would be a useful enough example, but here are some other tips you might like to note.

First, in order to prove out your work, with 100 or more candles on the chart, you 'should' be able to run an EMA-34 through this pattern, as we have below.

|

| Russell 2000 E-Mini Futures - Hourly - With EMA-34 |

When you do this, you 'should' find that every numbered wave winds up on an opposite side of the EMA-34 which helps assure "form and balance" in your count. And, as you see above, it does!

Next, if you add the Elliott Wave Oscillator as an indicator on the chart, you 'should' find that if this pattern is truly a diagonal, that the highest momentum will be in wave (1). Let's see.

|

| Russell 2000 E-Mini Futures - Hourly - With EWO |

Well, as you can see from the above, the peak of the EWO occurs in wave (1), with lower momentum for waves (3) and (5): with them currently showing as divergences. You will also note that sometimes in a diagonal, wave (4) does not always come back to the zero line, as it does in an impulse. This is often because wave (4) is usually shorter in price & time than is wave (2), in order to maintain the diagonal definition.

We know that some people take a much more casual approach to counting waves, and sometimes if they see any contracting pattern, they call it a diagonal. But, we have seen many on the internet where the prospective analyst doesn't even have overlap between waves (4) and (1). This is just asking for trouble in wave counting. Why count patterns incorrectly when there are numerous example of patterns that follow the rules that can help guide the way to a successful Elliott Wave experience?

For completeness, if there is any error on the chart, it is most likely on the extreme right-hand side of the chart. Due to the compactness of the waves, and difficulty in counting in that area, it is possible that wave (5), up, is really just wave

a of (5), up. And that would be reasonable given the lengths in time of waves (3) & (1). But that possibility can be seen

in advance, and planned for as needed from a trading perspective. Remember, wave (5) does not invalidate upward unless or until it became longer than wave (3).

Still, the market has already started lower and there is no reason to question the count unless the high of (5) was exceeded. And, in particular, if the low of the

(e) wave of the triangle were exceeded lower, it would likely confirm the end of this particular upward wave sequence, and that a move lower was underway.

We hope this type of clear example furthers your Elliott Wave education, and makes you more of a believer that the rules and guidelines

can be followed to yield the correct results. There are numerous examples on the web of people who don't follow the rules and guidelines. For example, there is one web-site that even today lists a pattern termed an "irregular zigzag". In other words, it would be, if the pattern existed, a zigzag with a higher

b wave than the start of the

a wave. The fact is that there is no such pattern. Such a pattern would "break the rules" for the very definition of a zigzag. (P.S. the correct pattern is a flat). Yet, this site keeps brandishing it's version of

can do no wrong Elliott Wave, and yet gets all of the major turns incorrect.

In the most recent example, this web-site had bought the

bullish fever, and, even as we were looking for a turn for Minor 4, and called the triangle, and the last wave, it was

still trying to count a never-ending series of

micro waves higher! Wrong yet again. Wrong at the May 2015 top, wrong at the February 2016 bottom, wrong at the August 2017 high. And keep in mind this site wants you to

pay handsomely for an Elliott Wave education!

You, of course, are free to do as you chose. We will always admit our errors here, and look for why they occurred - even to further our own education. We think it's as much about the journey as it is the results, and we hope you agree.

Have a really wonderful weekend.

TraderJoe