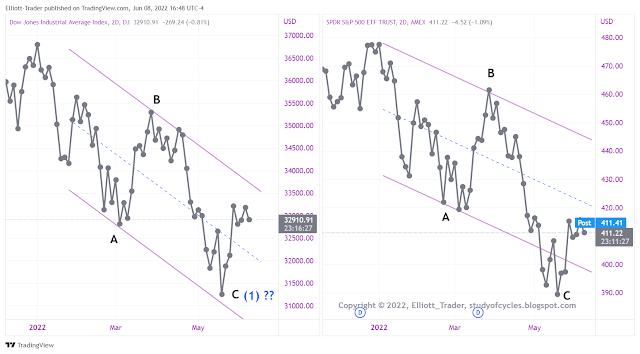

I have written often about Elliott Waves in a potential fourth wave position referring to this phenomenon as The Fourth Wave Conundrum (TFWC). This weekend the SPY hourly wave structure and our lack of knowledge about the outcome make this an ideal time to clearly illustrate further The Fourth Wave Conundrum with a series of charts. To do so, recall that the primary wave structures for sideways fourth waves are Flat, Triangles, and Combinations. Let's look at the first chart.

|

| SPY Cash - Hourly - Running Triangle Variation |

As you know, the most prominent feature of Friday's session was the gap down on the Payroll Employment Report. The key question becomes, "will this gap fill, or is it the start of something larger to the downside"? One way the gap could fill is with the triangle variation of a larger fourth wave. In this case, in the cash market, because the ((B)) wave is above wave iii, it would be a 'running triangle'. There is some support for this count because of the decided lack of follow-through on Friday. However, this variant would invalidate if prices travel below wave ((A)) of the triangle. If it holds, then the other waves must form properly.

The next way the gap could fill is with the larger Flat (or combination flat) variant, as illustrated below.

|

| SPY Cash - Hourly - Flat/Combination Flat Variation |

In this case the wave sequence is labeled as ((W))-((X))-((Y)) and the purpose of the pattern is to get the wave structure down to the 38.2% Fibonacci level, or greater, for a deeper fourth wave, and one that is longer in time, too. In trying not to rush the wave count both the triangle and the Flat are excellent candidates. They may be trying to create a fourth wave that better approximates the number of bars in the third wave.

The last way the gap could fill, and still not be a further correction is by the formation of a diagonal count. From wave iii there are three-waves-down. This is the deadly structure that can start all of this potential confusion. Here is how the diagonal could form from here.

|

| SPY Cash - Hourly - Diagonal Variation |

Similar to the triangle, 'a cousin pattern', this variant would invalidate at the same place. Then, there are more waves to have to form properly with the third wave shorter in price than the first, and the fifth shorter in price than the third.

The next variation in The Fourth Wave Conundrum is actually that the market topped as shown.

|

| SPY Cash - Hourly - Market Topped Variation |

In this case, the gap actually starts the next wave lower, and a second wave may still be under development if a new high is not made. Keep in mind that since the ES futures did not make a new higher high, it might also be considered a 'truncation top'. We will next add the first variation of the prior (magenta) parallel trend channel to this count.

|

| SPY Cash - Hourly - Initial Elliott Parallel Trend Channel |

The support for this count comes from the attack of the vth wave on the mid-channel line and failure there. Then, there is a back test of lower channel line which fails. In this count wave iv did not hit the 38.2% retrace unless the wave ii low is moved up to the location of ((2)) as we noted was possible particularly in the futures counts we provided in prior posts. Certainly possible.

We will also add, but not illustrate that the market could form additionally complex structures for a fourth wave. These are primarily structures like: flat-x-zigzag, flat-x-triangle and triple combination. And this almost finishes our illustration of The Fourth Wave Conundrum. There are two things to add. First, is that it is possible to drop the initial (magenta) parallel and still have it be valid as in the following chart.

|

| SPY Cash - Hourly - Modified Elliott Parallel Trend Channel |

In dropping the parallel for a larger fourth wave flat or triangle, it is best drawn to the high of the "b" wave and the lower parallel then provides target point for the fourth wave. This might also coincide with a 38% or 50% Fibonacci retracement level. Doing this allows that wave iii to pop over the top of the channel as we have illustrated often happens when the third wave is the extended wave as per The Eight-Fold-Path Method for Counting an Impulse. In our general experience, once the parallel is lowered beyond the 'b' wave high, the odds of the impulse surviving begin to drop precipitously. This is because too many of the wave peaks/troughs get cut off to satisfy the requirements of the parallel.

The last thing to add is that The Fourth Wave Conundrum occurs at every degree of trend. It is one factor that allows the market to survive by tripping traders up, creating thrusts and fake-outs that can cause account losses. So what is a trader to do? I often say that a key symptom of TFWC is that everyone wants to know what the count is. Well, here are some factors you can consider.

- Is the fifth wave, v, yet the length of the first wave? If not, there might be more upside.

- Are trend lines from the low repeatedly being broken without lower lows? If so, think triangle.

- Do you have 120 - 160 bars on the chart, and what is the position of the Elliott Wave Oscillator?

- Are marginal new highs being made each day? Then consider a possible diagonal.

- What is the direction of gaps and are they being filled or not?

If you try to honestly answer some/most of these questions you will see that "more wave structure is needed to decide". Yes, precisely. The payoff for this diligence is that there should be either three-waves down of significance or perhaps even a new low below the low of wave i. That might be worth capitalizing on.

We hope that the awareness of the phenomenon helps you be patient in Elliott Wave counting. And we further hope that this awareness reduces perhaps the propensity to over-trade during the uncertain conditions which are presented. This is the second post since Friday and if you have not read that one yet you might like to.

Have an excellent rest of the weekend.

TraderJoe

%20Wave%204.png)