I have been droning on for days and weeks now about how the market recently has been starting down from its local highs in expanding diagonals. I asked you not to get perturbed with me: the market is making the patterns; I am just trying to count them. Now why is this at all important? Well, if you were trading in the years 1990 - 2007, you would have seen the venerable Dow Jones Industrial Average make this pattern in the weekly chart.

I counted this pattern in real time, and so I remember it well. I also remember where I was able to take advantage of the count, and where the count was able to take advantage of me. It is definitely an expanding diagonal pattern, with ((v)) > ((iii)) > ((i)), and ((iv)) > ((ii)) where wave ((iv)) overlaps wave ((i)), but yet wave ((iv)) does not travel above the high of wave ((ii)).

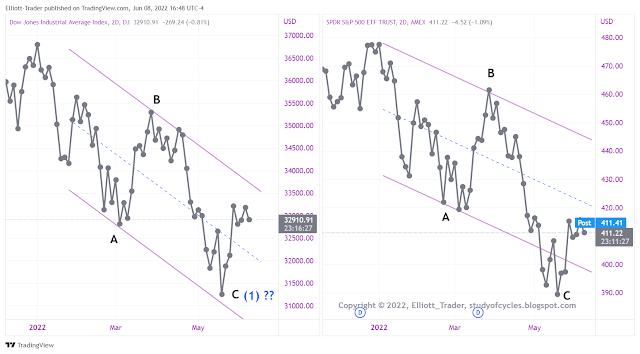

The diagonal is just the Minor A wave. There is a large three-wave B wave, up, after that, followed by a strong and swift non-overlapping Minor C wave down to make the even larger Intermediate (A) wave which is a wave in a three-wave sequence from the high. The Expanding Diagonal Minor A wave is a "Leading Diagonal". There is a lower low after it. It did not 'have to be' leading, but it was. Diagonals are 'often' A waves. This one was, too.

After Intermediate (A), down, not shown but almost all chartists know there was an Intermediate (B) wave that went marginally over the Dow's 2000 high prior to the financial crisis Intermediate (C) wave to the 2009 low. So how does this apply to today? I think each major equity index is in this position shown for the Dow and the SPY below.

As far as I can tell, we have three waves down in each index in 5-3-5 format as Minor A,B,C. I have also shown a tentative larger blue Intermediate wave (1) for the Dow. Will an expanding diagonal or contracting diagonal come to fruition? I simply do not know. I am counting waves. But, as in the Dow example, the retraces can be quite severe. So, one must be patient and follow the rules for both types of diagonals.

Is it possible to "go over the top" again? Yes, it is. With a pattern like this The Fourth Wave Conundrum is in full swing. We are watching it operate on a lower time scale on smaller waves if you are following the comments.

But, be forewarned. See what that Dow did in 2000? Just keep it in mind is all I ask. You had to be there to see it, to experience it, and to fully understand its implications. All I can do is share that with you, and hope it provides some learning for those who didn't experience it.

Have an excellent start to your evening.

TraderJoe

FXI - For Kelly O - update

ReplyDeletehttps://www.mediafire.com/view/j31xma582ctb7eq/FXIupdate.PNG/file

thoughts on gold miners (GDX)?

DeleteThanks!

DeleteIndeed. Price action ideally suited to erode trading capital of bull and bear alike. Duly noted, and thanks for the caveat!

ReplyDeleteWelcome. TJ.

DeleteUNG (dly) Looking a little dicey up here -

ReplyDeletehttps://www.mediafire.com/view/1aym9nawvhq17gu/UNG.PNG/file

Thanks so much, I really hope this doesn't happen, but now I'm prepared. I would think some stocks like ARKK and other beaten down tech may outperform as the market chops around like that. Also, the Transports were down over 3 percent today, sometimes a leading indicator.

ReplyDeleteWelcome. TJ.

DeleteWatching IYT closely. It is indeed challenging the support shelf of the consolidation pattern around 228. I agree a decisive break and close below could be a harbinger for the other indices. Holding so far though.

DeleteES (5x3) New DBBO

ReplyDeleteDiscretionary - We've made a higher high, can we muster a higher low?

ReplyDeletehttps://www.mediafire.com/view/hri2u0jpbm1pkp0/Discretionary.png/file

Addendum: XLY/XLP -

Deletehttps://www.mediafire.com/view/olqtxi2iw0lb2nf/xlyxlprms.PNG/file

ES (5x3) Late look -

ReplyDeletehttps://tvc-invdn-com.investing.com/data/tvc_ad000c797e4a224dd7bbe974ae47baf3.png

ES (5x3) - A pair of traps -

ReplyDeletehttps://tvc-invdn-com.investing.com/data/tvc_8536c4c124588493c33ce74eaf9173f3.png

What's the best free online source for studying P&F?

DeleteYou could start with Stockcharts. But, there are a few books that should be required reading. Check out Stockcharts first, then if still interested, we can

Deletetalk about book sources. :o)

Thanks

Deletezig zags till death

ReplyDeleteKelly - stockcharts had some good resources, but DuPlessis book is amazing and I highly recommend it - Greywaver suggested it to me :)

ReplyDeleteRBOB - (0.025x3) retesting high

ReplyDeleteIm thinking we need a 4 and a 5 yet.

DeleteSPY (2x3) - Possible pattern perspective

ReplyDeletehttps://tvc-invdn-com.investing.com/data/tvc_42bee6c5c1f92a59c078a29a96e00012.png

Agreed! Really looking like a,b,c,, or w,x,y and I suspect the latter owing to duration.

DeleteI'd like to see a flush on CPI tomorrow and then a reversal. Over 416 on spy and we're going much much higher.

DeleteJust an observation - [IF] this sideways movement is a continuation accumulative base, a false breakdown (spring) would be a nice way to flush out some longs, trap some shorts, and send us north.

ReplyDeleteSPY 5-min: did the expanding diagonal at the top start an impulse lower? There is a 1.618 wave able to be considered.

ReplyDeletehttps://www.tradingview.com/x/Ap2xWYAY/

Just be careful because a larger triangle could cross the black-dashed line. The current pattern is a 'barrier triangle' with slight lower lows, but not lower closes below iii.

TJ

ES (5x3) New DTBO triggered -

ReplyDeletehttps://tvc-invdn-com.investing.com/data/tvc_3099f80c77610e860560d23b089119e6.png

SPY 5-min: have tagged the upper parallel and can be in several corrective counts, still including a triangle, but not below the low.

ReplyDeletehttps://www.tradingview.com/x/GU5klEAR/

TJ

SPY have tagged the lower barrier again, and can make a 'e' wave up if it wants, but not over the prior high.

Deletehttps://www.tradingview.com/x/HMbpNH8t/

TJ

Don't recall ever seeing flagging action this massive...a big move is coming...!

ReplyDeleteSPY ..5-min has the new lows after the triangle. Now, why the impulse?

ReplyDeletehttps://www.tradingview.com/x/usEYw1qD/

TJ

..also broken the 7 June low. TJ.

DeleteES futures ..also broken the 1 Jun double-bottom lower. TJ

DeleteSPY (5min) - an area of interest

ReplyDeletehttps://www.mediafire.com/view/7zqtdnxvwmt2rm4/SPYaoi.PNG/file

DeleteApparently they weren't that interested. 🥱

DeleteSPY 1-Hr: hate to say it; here is that expanding pattern off of the top again.

ReplyDeletehttps://www.tradingview.com/x/NbG29sCs/

TJ

gap fill on SPY would be below 405.29; TJ.

Deletegap filled. TJ

DeleteI like this idea. There is heavy resistance at 415 on spy and we have not cracked it after about 5 attempts, so I think buyers are trapped and sellers have control at this point.

DeleteSPY 5-min: in that expanding count, maybe the triangle is the "b" wave in cash, as the futures have upwards overlap. Doesn't 'have to' be an impulse although it looks like one. TJ.

ReplyDeleteqqq gap fill at 300. Gonna wait till after the CPI whipsaw tomorrow.

ReplyDeleteSPY 1-Hr .. again, as I pointed out at the time to those who posted the triangle-type count overall "usually" contracting triangles don't have double-bottoms (i.e. flat bottoms). Prechter has pointed this out on a number of occasions. So, even though a contracting triangle was 'possible', it was lower odds. TJ.

ReplyDelete"typical" ratios for triangles are 78.6 - 80% max. TJ.

DeleteSPY 5-min: just fyi - triangle thrust target of 4,046 (widest width of triangle, subtracted from breakdown point) has just been met at 4,044. TJ

ReplyDeleteES (5x3) Updated -

ReplyDeletehttps://tvc-invdn-com.investing.com/data/tvc_05ebfe1484f30b4377db9dc827007fa2.png

Could this be our false breakdown (flushing longs, trapping shorts)? I'm waiting for the "trapping shorts" part, lol.

Deleteq's gap filled!

ReplyDeleteA new post is started for the next day.

ReplyDeleteTJ