ES Daily Candle: Higher High, Higher Low, Higher Close: Trend Candle

Market Posture: Neutral-to-Negative

Daily Swing Line: Higher

Daily Bias: Up (Settle Above 18-day SMA)

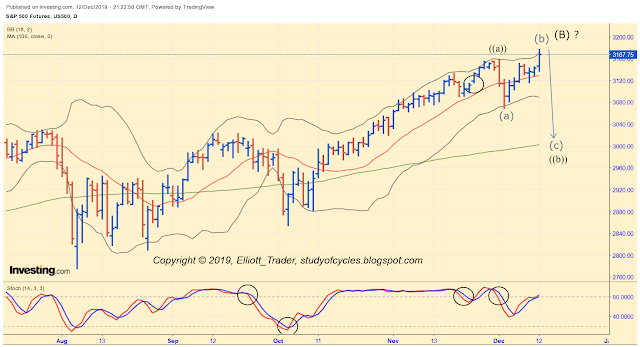

Tariff tweets - about what was already previously announced, that being a potential Phase I deal - sent the news reading bots into a frenzy and jammed the ES daily futures up against the upper daily Bollinger Band.

|

| ES Futures - Daily - Into Upper Band |

The first touch of the daily band is often (not always) where the Smart Money "takes some off of the table", especially with the daily slow stochastic in over-bought territory and not embedded.

With this being the case, the DOW also came into position where it can be the (b) wave of a flat, as well as the ES futures. While the upward (b) wave may not exactly be done yet, we know that Ira Epstein usually teaches not to "buy new" against an upper daily band (see Ira's Guidelines HERE if you have questions). That is not trading or investment advice from me - just a summary of what Ira teaches.

So we have sketched in, above, how we think the Intermediate (B) wave could eventually come to an end. At the moment we do not see a "five wave up move" from (a). Do you? So, let's take it slow and steady - one day at a time, and recognize the highly choppy nature of this advance.

Have a good start to the evening.

TraderJoe

TJ

ReplyDeleteNotice on your daily chart the Negative Divergence in the new high

unconfirmed by the lower high of the Slow Stoch !

The simple truth about binary options which many of us do not know is the fact that it is mainly based on predictions. Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. That is why it is important to be tutored or mentored by a professional investor in binary options. During my weeks of being mentored by Mrs Patricia Morgan, I’ve learnt much and also succeeding in trades and was able to recover my lost funds. Feel free to contact her on patriciamorgan984 @ gmail .com for positive results or contact her on Whats App on +32460230365

DeleteRare futures gap higher. Looks like the 3200 round number in Mr. Market's sights....

ReplyDeleteBoris Johnson reportedly on track for big majority in UK election.

ReplyDeleteHe needed 11 seats and looks to pick up 50!

DeleteThe EU's days are numbered...

I'm confused and perplexed that you and Glenn Neely -- two of the all-time best market timers -- can be so out of sync! You have us in an imminent (C) wave down and Neely has the S&P going to 3400 by the end of January 2020.

ReplyDeleteThere is a too much strength for a top right now.

DeleteYou are not the only one. This market is stumping a lot of very good analysts of all stripes. I know a number of very experienced traders who are no longer using what used to be very reliable indicators because of the plethora of whipsaw signals that have been generated the past few months. Some cycle gurus say we are putting in a 500 year cycle top, so we are likely seeing market behavior not seen in any of our lifetimes. Word on the street is that Poszar's article really spooked Powell and gang and they told Trump to speed up resolution of the China trade dispute and that they also ramped up the printing presses. Looks to me like panic-time...

ReplyDeleteEveryone is discounting QE, it’s a skew

ReplyDeleteYes sir! I am completely baffled by why so many EW analysts refuse to acknowledge its effect.

DeleteHe is brilliant though

DeleteIf you are talking about Prechter, with whom I have had quite a few exchanges about this, he still insists that news announcements, events, etc do not affect how Elliott waves unfold, and that any apparent correlation is merely co-incidental, and that the waves would have unfolded the exact same way with or without such c0-incidental announcements and events. When we look at how markets react to Presidential tweets and Kudlow jaw-boning about China trade, that is a remarkable position to maintain. I agree the man is brialliant but on this point I think he very obviously mistaken.

DeleteWell, that overnight up gap in the futures didn't last long. It was filled by 8 AM ET this morning.

ReplyDeleteTJ mentioned that in addition to their rarity, ES gaps are generally more quickly filled than cash sesson gaps.

ReplyDeleteI have never ever previously witnessed a same session exhaustion gsp in ES. I went back a few years and could not find a single one. What worries me is the more evident signs of market weakness become, the more reckless and panicky the CBs cabal will behave. Is Poszar onto something?

Boris gained 51 seats. Sadly for the good folk in the U.K., the EU criminals are going to make them pay...

ReplyDeleteES futures now have a new lower local low, before a higher local high - still in the overnight session.

ReplyDeleteA new post has been started for the next day. It is another Interim Report.

ReplyDelete

ReplyDeleteI got my already programmed and blanked ATM card to withdraw the maximum of $1,000 daily for a maximum of 20 days. I am so happy about this because i got mine last week and I have used it to get $20,000. Mike Fisher Hackers is giving out the card just to help the poor and needy though it is illegal but it is something nice and he is not like other scam pretending to have the blank ATM cards. And no one gets caught when using the card. get yours from Mike Fisher Hackers today! *email: blankatm002@gmail.com you can also call or whatsapp us Contact us today for more enlightenment +1(301) 329-5298