In a prior post (see the post entitled Trillions, June 6th 2020, at this LINK), and subsequent ones, I have contended that we are in a Primary ((B)) wave higher. Since that time, many EW Professionals, pundits and YouTube videos have all but promised stocks would crash. I did not. The most I could see were corrections along the way. For a new over-view of the larger labels in the same context (with daily Elliott Wave labels removed for a moment) let's look at the weekly chart,

|

| ES Futures - Weekly - Degrees |

The chart shows that after the Intermediate (B) wave high in February 2020, the decline that proceeded was to a Primary degree ((A)) wave. Why? ..because the decline is too large in price and the whole structure from 2018 is 'too long in time' compared to prior Intermediate waves to be anything less than the higher degree. And now, the chart shows that we are nearing the 1.382 external retracement of the Primary ((A)) wave down. There are possibly other external retracement levels this wave could eventually make - such as 1.50, or 1.62. The Primary ((B)) wave is marked with a right-arrow (>) to show that the wave is still in progress.

There are two features of this chart to note. The first is the largest correction in Time in the up move since 23 March is marked on the chart, but it is still exceptionally short in time compared to the number weeks of prior up-trending waves.

The second thing to note is that we just had an "outside week up" at the higher end of the chart, and close to external retrace levels. I will only paraphrase Ira Epstein here, "if the low of an outside week up is exceeded in the next two trading weeks, then it constitutes a trap for the bulls". This bar is also over a former weekly wedge line, so it must at least raise an eyebrow. If price over-throws a wedge, and then trades back within the wedge, it is often a sign the wedge will break in the opposite direction. Just keep that in mind: there is no signal from price, yet, that it has turned.

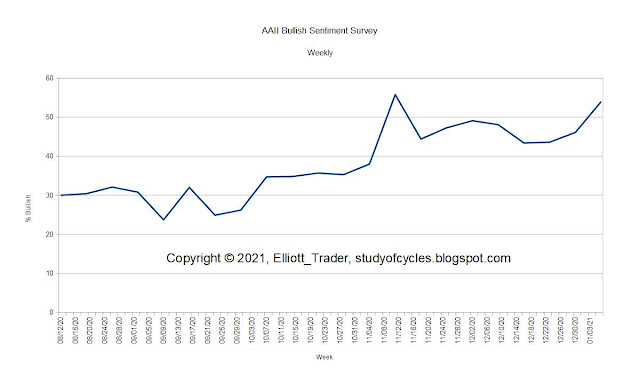

Before we go to the daily chart, we know that Thursday's put-call ratio reading was again a very low 0.38, indicating very bullish sentiment from an actual market-based measure. It did back off a bit on Friday. Next, let's look at the recent AAII Sentiment Survey.

And, we see this measure is approaching local highs as well. My own proprietary sentiment measure shows overall bullishness from professionals, newsletter writers and the public at the highest level since the 23 March decline. It is at 59% bullish, versus 28% then.

With that in mind, and assuming we have prior wave labels correct, it begs the question of whether we will get a larger-in-price (X) wave down on the daily chart. First, here is the four-hour chart of the Dow Jones Industrial Average. A count like this has been unseen on this scale. It is a mess!

|

| DJIA - 4 Hr - Minor B ? |

It is currently being counted as a diagonal minute ((a)) wave up, followed by a complex flat, or triangle minute ((b)) wave downward, followed by an impulse minute ((c)) wave upward to a Minor B wave. Within a zigzag wave, the diagonal and the impulse alternate as they should. This may be inside of yet a smaller wedge - as shown. If this count is nearly correct, then, the overall pattern being made on the daily chart could be this one.

|

| Schematic - Primary ((B)) Wave |

You'll note the current pattern of variation of the corrections shown: first, the running flat for the B wave. Second the zigzag for the A wave. So, why is an expanded flat being seen as the possibility here? Because if you remember back to the Intermediate (B) wave, up of Primary ((A)), down, there was most-likely a triangle in the middle of that structure. So, it seems unlikely that there would be a triangle in the middle of this structure. I could be wrong, but that's what alternation suggests.

Further, the Expanded Flat and some downward price length, gives the Intermediate (Y) wave up more time to progress further without necessarily making a lot more price progress. For example, maybe a channel would fit around the entire correction instead of a wedge.

Those are some thoughts. Clearly, for any downward wave to begin, breaking of the current 30-minute up channel - explained in yesterday's post - and larger four hour wedge (as shown above) are needed, as are back-tests that fail at the lower channel/wedge lines.

This is the second post this weekend. If you haven't seen the first one, yet, you may wish to view it now.

Have an excellent rest of the weekend.

TraderJoe

Thank you for the explanation. I will never figure out EW., lol. I totally agree that sentiment is overly bullish.

ReplyDeleteTo some degree it's about 'proportional' time and price. Cheers.

DeleteHere's TJ's 4hr DJI from a close only/RSI perspective (a good lesson) -

ReplyDeletehttps://funkyimg.com/i/39XG6.png

Wow, fantastic work. Could you please give us an example of your favorite type of HD set up ( you mention 3 )and what TF is best. I see you use 4hr. a lot. Thanks GW.

DeleteThe reference to 3 types relates to divergence itself. Regular, reg.(hidden), and HD. I would surmise that those TFs followed by most would yield best results. The smaller ones can be overrun by the larger more widely followed ones (just my observation).

DeleteObservations on a couple of risk on - risk off gauges (daily/weekly) - fwiw

ReplyDeletehttps://funkyimg.com/i/39YjN.png

If we continue higher these are SPX targets I’m looking at for possible reversal areas. Extensions 1.382% of A = 3853, 1.50% = 3995, 1.628% = 4149. GW’s monthly target 4277.

ReplyDeleteToo many people now calling for SPX 3860 as the top so it will likely drop before that or rocket past that level

ReplyDeleteWe have now had two consecutive daily closes above 3800, which suggests the bears have already lost this particilar round number battle. If past pattern obtains, we should expect the 1.50 extension and tag of 3900 at the least. I expect if that represents a top the reversal will be swift and immediate. Protracted battles at or around the round numbers almost always means the bulls will prevail and price will grind upwards toward the next round number target, in this instance 3900. Every time it appears that pattern will be broken, the march higher inevitably resumes, and the upside target is achieved. Truly uncanny!

DeleteRussell may have started it's reversal Friday. Look at rty. Anyway, noone is saying that, so I will :)

ReplyDeleteShould this b wave take more time than the b wave of expanded flat which ended in March at low?

ReplyDeleteIt has already taken more price. It is reasonable to conclude this Primary ((B)) wave will take more time than the prior Intermediate (B) wave.

DeleteYou probably explained this to me previously but I am always puzzled everytime I see a three wave pattern designated as an "A" wave, as is your primary A wave in the chart.

Delete@Tachy .. three waves down to A can start a 'Flat' wave, provided that it's B waves makes a 90% or more upward retrace. In a 'Flat' the B wave can go over the high by 105 - 150%. If you are not familiar with the basic terminology of a Flat, you need to read a basic Elliott Wave book, like 'The Elliott Wave Principle' by Frost & Prechter.

DeleteO.K. I remember. Flat is 3,3,5, even at primary drgree,and the overall structure is still a.b.c...

DeleteEvening look at 5min -

ReplyDeletehttps://funkyimg.com/i/39YWU.png

If interested, follow up to last night's 5min -

Deletehttps://funkyimg.com/i/39ZvH.png

Pre-open look on higher TF 4hr -

ReplyDeletehttps://funkyimg.com/i/39ZsW.png

Correction: The RD(4) is mismarked. Should just be an RD from the Jan 4th peak.

DeleteIt was slightly higher than the peak 4 bars earlier.

From a pattern perspective, the hrly (currently) has the look of a possible H&S in the making. fwiw

ReplyDeleteWatching DJIA 31K and SPX 3800. They spent a phenomenal amount of moolah trying to reclaim those levels. I think a close below short-term bearish with likely retest of RN below...

ReplyDeleteGood afternoon all.. SPX cash 30-min; two closes below channel. It is 'possible' than a ending diagonal could rise from the ashes here. So just be careful. There is no real good confirmation yet.

ReplyDeletehttps://www.tradingview.com/x/iLxDT6hO/

If there is to be no upward diagonal, then the wave would appear over.

TJ

I take it the over-lap precludes an upward impulse as labeled, but the potential diagonal does mot appear to be of the contracting sort...

DeleteA new post is started for the next day.

ReplyDelete