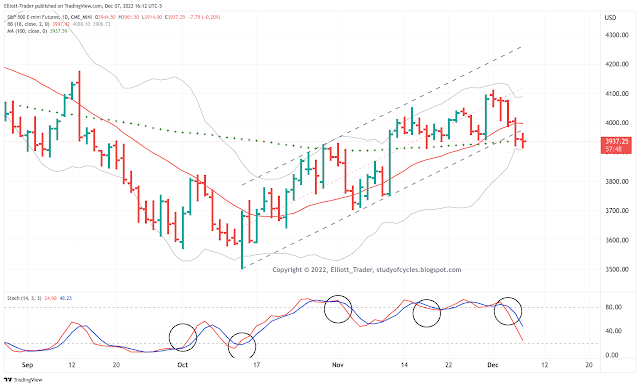

Today was a fairly narrow range day and might represent some of all of wave iv from yesterday's intraday chart - see LINK here. As of this time there was no upward overlap on wave i of the potential impulse. The daily ES futures did make a new daily low early in the morning, but then they formed a doji by the close of the cash market and price is still fighting at the 100-day SMA. The daily chart is below. Today was the second close below the parallel, and the close is still below the 18-day SMA so the daily bias is still down.

Tomorrow could be another whippy day. It might start lower on comments from the ECB (Christine LeGarde, see Economic Calendar) or the weekly jobless claims and - based on the wave count - it might then whip around higher, perhaps after testing the lower daily Bollinger Band. We don't know for sure; we just surmise from 1) the wave count, 2) the news, and 3) the market's position relative to the band.

The daily slow stochastic is in over-sold territory, so the market might have a bit more down-side but would not like attract the new positions of the so-called Smart Money. Rather, the first hit of the lower band, in conjunction with the 100-day SMA, is where the Smart Money may merely take some profits and wait to see what occurs next. The Bollinger Bands are beginning to narrow in a bit, so some consolidation might follow.

We note that the 18-day SMA ("the line in the sand") is still above the 100-day SMA, and it has not crossed lower yet. If it were to do so, it might provide more confirmation of a market turn lower.

Have an excellent start to your evening.

TraderJoe

Best way I can draw the channel and it did die in the middle. Don't ask me to count the 4 and 5:).

ReplyDeletehttps://imgur.com/Groxayn

Delete3900 level is key, weekly 18ma

ReplyDeleteNice post TJ, thanks. Agree, would like to hold above (at least) the 3880 - 3910 area. Resistance at 3960 area tough so far

ReplyDeleteTrendline backtest would make a nice fib retrace. Good luck all today.

ReplyDeleteAgree!

DeleteAAPL looks like a C of 4 is finished, fwiw.

ReplyDeleteGC to $1892? (a = c), still within its channel

ReplyDeletehttps://schrts.co/IvJWdSba

ReplyDeleteI think early next year the risk/reward is better for bonds than stocks. Reversion to the mean should happen especially if we get a nasty recession.

tlt/spy looks very promising

DeleteA new post is started for the next day.

ReplyDeleteTJ