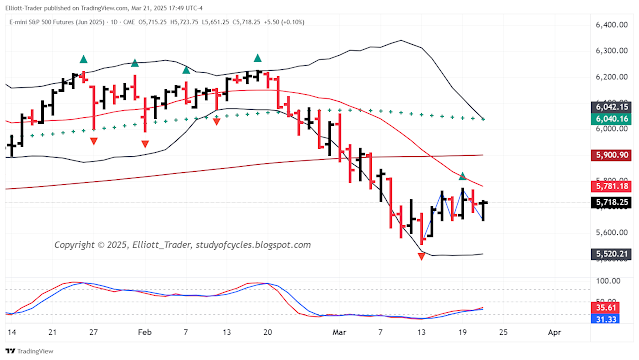

Today in the daily ES futures made a lower low, primarily overnight, touching the lower daily Bollinger Band, then turned around to close higher. The lower low below the 18-day SMA continued the swing-line extension lower, but, according to Ira's method, it is not in a trend as it has a previous higher high, and then the lower low. It is in what he terms a 'vertical price break'.

And while the front-month or June futures contract - and the SPY cash - made the lower lows compared to the March 13 low, the roll-over futures contract did not. This raises the suspicion that on the short term, a triangle or a Flat wave is being made. That being the case, it is possible for price to revisit the 200-day SMA, although that is not required. Price could just break down and make a further lower low which might then be a fifth wave of the decline.

Interestingly, on an up-close day, the daily slow stochastic lost its over-bought status and is now neutral. There were a couple of ways you could sniff out the possible up day: 1) the weekend stock-market videos were almost solidly bearish - a potential contrarian indicator, and 2) today is the last day of the month and usually sees the typical sloppiness of the window-dressing from portfolio managers with tomorrow as the first day of the new trading month which might see inflows from the usual sources (401k's, retirement accounts, dividend reinvestment plans, etc.). Very often, the futures front-run those inflows, and that may well be what occurred in the latter part of the day.

Of course, over the next couple of days, additional tariff news will be announced, as will the results of the President's third-term election results (..just kidding, I think).

Have a good start to the evening,

TraderJoe