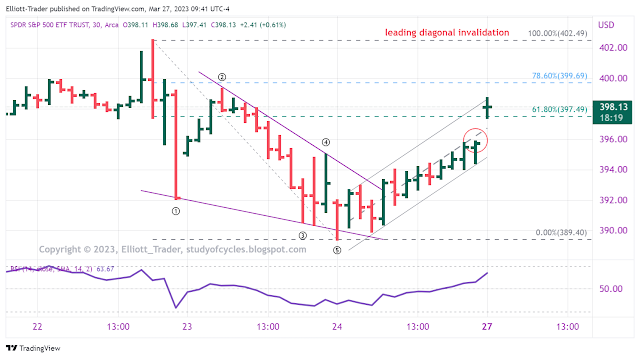

The half-hourly SPY cash chart is below. Price has gone over the 62% retrace, meaning that a 1.618 or greater wave downward can be supported IFF a down trend wave begins.

Right now we are watching the high, and watching the gap to look for clues.

Have an excellent start to the day.

TraderJoe

Two clues: SPY gap fill and channel break.

ReplyDeletehttps://www.tradingview.com/x/U3ShWpWB/

Might put a wave counting stop above this morning's high.

TJ

Not sure but this is what I'm seeing

ReplyDeletehttps://www.tradingview.com/x/EGpF0Td2/

Is this a 78.6% 'deep retrace'? If so, then a 'lot' of downside acceleration is needed.

ReplyDeletehttps://www.tradingview.com/x/0hGjhe7y/

TJ

Tough markets tj. Thanks

DeleteMight be trying to form an expanding diagonal. Still needs development

ReplyDeletehttps://www.tradingview.com/x/k4nN84Bk/

No acceleration yet; maybe tomorrow. TJ.

ReplyDeleteAcceleration occurring to the upside currently

ReplyDeleteIsn't diagonal invalidated?

DeleteThe 'leading' diagonal is not invalidated quite yet. I don't know what you are following. The diagonal itself will not be invalidated. It is what it is. It might turn out to be an 'ending' diagonal. TJ.

DeleteChart as of now in cash. Futures are the same.

Deletehttps://www.tradingview.com/x/yGbP74xy/

TJ

Spx 4015 and fast drop to start wave 3 down.

ReplyDeleteTj,

What is the invalidation point 4020?

Or 4041 ??

Wondering if this might be forming

ReplyDeletehttps://www.tradingview.com/x/yE4NcNZZ/

Another possibility shorter term

ReplyDeletehttps://www.tradingview.com/x/NJgYocMN/

The market has been hovering around the short call of JPM's collar trade.

ReplyDeleteIf contracting diagonal was ending, then I think we are in c of b of (B) of the large triangle from ATH. I think going over the top really puts some nails in the bear coffin.

ReplyDeleteOK. So on the triangle idea - which I have been thinking a lot about. And also recognizing the stock market's up move has not ended with a really fine ending diagonal: what if the triangle was the 'inverse', not wave four, but a wave (B), as below.

Deletehttps://www.tradingview.com/x/60Sw4xwf/

This would allow the more typical 62% retrace for the second wave of an ending diagonal wave. Think it over.

TJ

A new post is started for the next day.

ReplyDeleteTJ