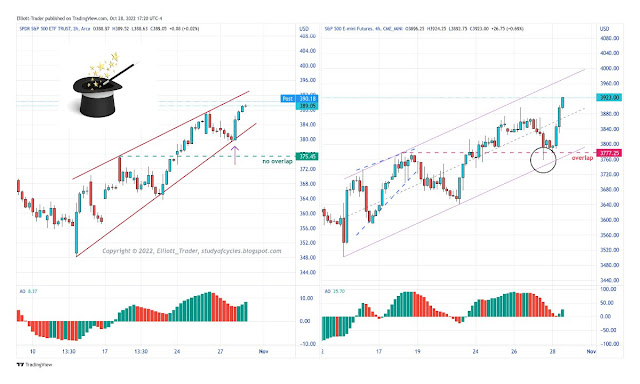

Although I don't publish it every day, here is a reminder of the intraday wave-counting-screen. It is always the ES futures 30-min chart. And while I don't publish the chart every day, I generate it for my own wave-counting-purposes every day.

Reminder that it includes: 1) 18-period SMA, red line "the line in the sand", 2) 18-period Bollinger Bands with +/- 2STD (grey bands), 3) the 100-period SMA (green), 4) the daily pivot points - classic calculation (for reference only) shown as orange and violet bars, 5) the Bill Willams fractals (2 period) shown as green and red up & down arrows.

Plotted in the indicator pane is the standard 14,3 slow stochastic (30-min intraday).

The chart is interpreted using the same rules/guidelines as in Ira Epstein's daily chart. Notice in last night's down move after five-six consecutive closes below the lower band, prices moved to the inside of the band.

Price bias is interpreted as positive if is above the intraday 18-per SMA, and negative below it (use in conjunction with the daily). The slow stochastic goes from embedded, over-bought, to over-sold and embedded using Ira's guidelines.

Those of you who have figured out Ira's "swing line" indicator can apply it as well. I do it in my head.

As of the open of trading this morning, it is clear there is a "battle going on" at the conjunction of the 18-period and 100-period SMA's, and it should be viewed that way.

Intraday, traders tend to get the most bearish when price is riding the lower band and makes several consecutive closes outside the band. Traders tend to get the most bullish when price is riding the upper band and makes several consecutive closes outside the band. This might be used as a contrary sentiment indication (again when used with the daily).

Ira advises never buying over an upper band or selling below a lower band on the daily and weekly charts. A similar filter can be used here when looking to identify the wave count. When consistently above the upper band or below the lower band, it might be a place where a significant wave terminal will occur. And inside bars might occur to consolidate or reverse the wave count and provide a better place where traders might enter/exit.

The Bill Williams fractals can be used as breakout/breakdown indicators.

Have an excellent start to the day.

TraderJoe

)%20waves.png)