U.S. Debt Clock: $22.53 Trillion

S&P500 Candle: Spinning Top

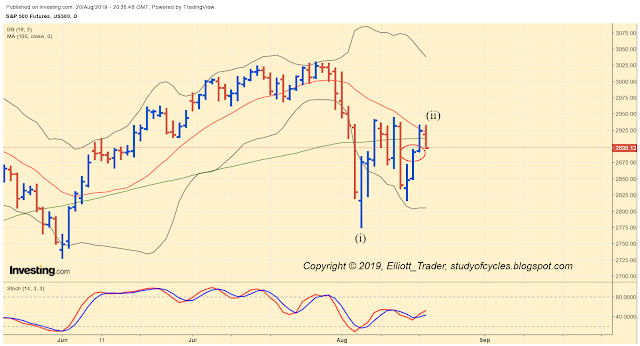

Market Posture: Neutral and Probing Waves

Swing Line: Up (Higher High, Higher Low)

Bias: Up

Tomorrow the U.S. Federal Reserve and other central bankers will supposedly provide more clarity on the state of monetary policy probably in a more global context. Of course, if you can believe any thing a central banker says, "good luck". Remember just a few short months ago when the FED said that "the balance sheet roll-off would continue on auto-pilot", or then, later, when they said, "It would end in September", and then later when they said, "No, no. It will end in August!".

Yesterday, we said there was no compelling reason to end a count on yesterday's bars. That statement was proved correct today with a higher high day. A spinning top candle requires a confirming candle lower.

|

| ES - Daily - Higher High Day |

So, the daily chart is quite neutral as we head into the Jackson Hole Summit. Prices originally popped higher. Still they did not exceed the 2,944 high of 13-Aug. After the marginal higher high, prices then reversed in five waves down from 2,940 to 2,904, yes, some 36 points, when they met the combination of the 18-day SMA and the 100-day SMA around 11:00 AM (ET) and found near-term support.

Prices then made a near-exact 78.6% retrace to 2,932 before falling off approximately 10 points near the close to 2,922.

There is now one way to count the wave (ii), above as complete. Two of us found it independently, and it can be interpreted to be a contracting ending diagonal as of today's high. However, the bias of prices remains up, and the swing-line is up even though there was a clear five-waves down made this morning. So, the chart is still fighting with itself (please don't blame your local Elliott analyst: we don't make the waves, we just try to count them). As further sign of the fight, the 18-day SMA has indeed crossed below the 100-day SMA, although this is usually better validated by prices trading below the moving averages, not above them as they are now.

Today we called the 78.6% retrace a retrace to a "Wave Counting Stop" or a warning about the intraday count. That level is often associated with "B" waves, so it might mean that a diagonal is still continuing or is in progress, and in this case "either" higher or lower. Here was today's intraday chart. The five waves down are on the left.

|

| ES - 5-Minutes - c = 1.272 x a? |

Then, it is clear there was a choppy wave sequence higher which we could not count as an impulse. Near the end of the day the wave measured c = 1.272 x a, which is a common measurement for a failure wave, before prices fell off below wave .iv at the end of the session. They have still not yet overlapped the a wave, but the blue .i wave has been overlapped.

So, the five waves down make the chart somewhat compelling, but a lower daily low, especially with a close back below the 18-day and 100-day SMA would provide improved confirmation. Why such caution? There is the potential of major news tomorrow - or it could be a "snooze conference" just as well. But, a lot of 78.6% waves have busted higher or been only part of upward diagonals etc. And, there are still ways to count upward. And, as well, the first five waves down with a 78.6% deep retrace could also just be part of a diagonal, downward to start a wave sequence, lower.

For this reason, patience, calm and a probing mentality might well serve the wave counting studies the most at this time.

Have an excellent start to your evening.

TraderJoe