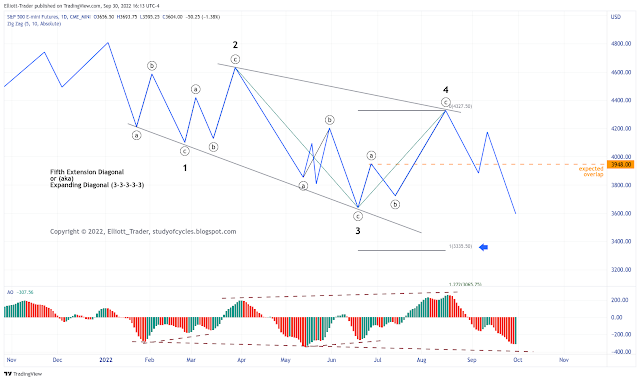

We have been contending for months that the all-time-high in the stock market was a Primary ((B)) wave and that the pattern in the downward direction is an expanding diagonal - which might be some or all of the Primary ((C)) wave, downward. The expanding diagonal is one of the few Elliott wave patterns that would explain both the choppiness of, and the unrelenting nature of, the drip, drip, drop decline lower. The ES daily chart, below, shows the schematic of the expanding diagonal wave in a real time, zigzag chart, akin to how Glenn Neely likes to plot Elliott Waves.

Note the blue arrow in the lower right pointing to the left. IF this pattern is correct, and if it is to be an expanding diagonal, then, the blue arrow shows the level at which such a diagonal would be validated. That level in the ES futures is ES 3,335.50 - and that level should be exceeded. IF it is exceeded, then wave Minor 5 would become longer than wave Minor 3, and establish an expanding diagonal that follows the rules.

Now because wave Minor 5 is often, usually also longer in time than Minor 3, then this wave can go on (given substantial and frequent bounces along the way) for quite a while. Wave 5 could become 1.618 times as long as wave 3, or even longer.

I will remind those that have read the Elliott Wave Principle by Frost & Prechter, that page 40 states, "This form appears to occur primarily at the start of declines in the stock market (see Figure 21). These patterns were not originally discovered by R.N. Elliott but have appeared enough times and over a long enough period that the authors are convinced of their validity."

Have a good start to the weekend.

TraderJoe

.png)