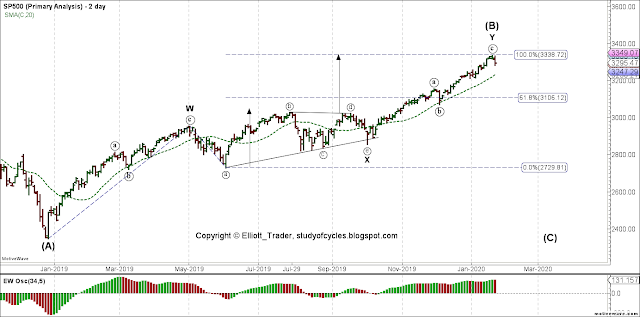

It would be wonderful to be able to predict the stock market with a high degree of precision. But, Elliott wave theory has several features that just refuse to pin down the market's options. One of those is "B" waves. They can be almost "any three", from a flat wave to a zigzag, a double zigzag, a triple zigzag or even a triangle. With that in mind, below is an update on the daily projection chart.

|

| ES Futures - Daily Close - Actual and Speculation |

Today made a lower daily low. and it had more impressive initial statistics than the first down wave with only 173 advancing issues and 1,736 declining issues. This is now a 1:10 ratio, and might represent a "kick-off" wave. So, it does appear a correction - at least - is underway. And maybe more. Unlike yesterday, there was no big rally into the close.

The length in price of today's wave down, is also shorter than the initial leg down, and therefore, today's wave down can well qualify as a sub-wave of the next move lower. The DJIA darn well almost made a new low below the January low. The ES did not, and reacted off of the 78.6% retrace level of that January low. The down move is picking up speed and may be part of the minuet (c) wave of the minute ((b)) wave - but that remains to be seen.

From here on out, one must follow retrace levels and overlaps closely on any further the downward waves. Again, given the nature of "B" waves, we want to back-off and not try to call it too closely. Today's low did pierce the lower daily Bollinger Band, and then closed just above it. Meanwhile, the daily slow stochastic is not yet in over-sold territory. so there can easily be some follow-through to this initial move lower.

Have an excellent start to your weekend.

TraderJoe

P.S. Correction. On the day after this was written, two different sources showed the NYSE Adv-Dec figures were more like 549 / 2652. This is still in the impulsive category at greater than 1-to-4, but still not a 1 : 9, or 1 : 10 kick off. My apologies for the error. Data vendors are what they are.

P.S. Correction. On the day after this was written, two different sources showed the NYSE Adv-Dec figures were more like 549 / 2652. This is still in the impulsive category at greater than 1-to-4, but still not a 1 : 9, or 1 : 10 kick off. My apologies for the error. Data vendors are what they are.