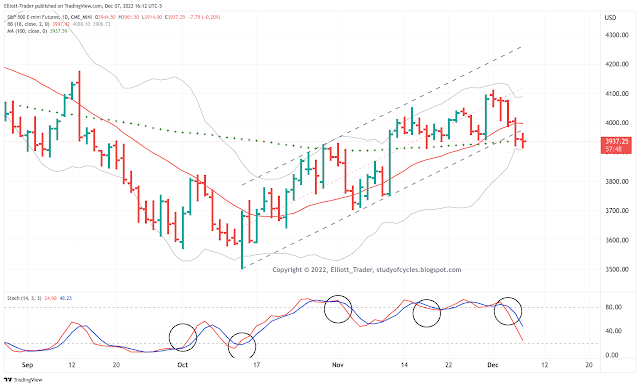

Daily ES prices continued to close above the 18-day SMA. Therefore, according to what Ira teaches in his public videos, the price bias remains up. The daily slow stochastic is still embedded. Therefore, the so-called Smart Money may still try for the upper daily Bollinger Band. They didn't do it today. They might have but it didn't happen. So, let's go down to the Intraday Wave-Counting-Screen, which mirrors on the 30-minute timeframe the same guidance as for the daily chart.

Here you can see the spike down in the futures which accompanied the Payroll report. Following this wave which was only about 1.27 x as long as the first wave down, there was not a fourth and a fifth wave down. The payroll candle took out the two previous down (grey triangle) fractals.

When prices turned and hacked & hacked higher, they initially created an upward wave which is followed by a down (red) fractal. However, price ended over the 18-period SMA, and so even the intraday chart ended with a positive price bias. The intraday slow stochastic is over-bought and not embedded at this time.

In the futures - besides the top being its own up (green) fractal - there are two other up (green) fractals that have not yet been broken.

We have tentatively labeled the down move as an ((A))-((B))-((C)) down. That's all there is. A fourth wave higher that did not overlap did not form, as neither did a fifth wave lower.

At this point, if one were to draw Ira's swing-line on the intraday chart, it would be indecisive because there is a lower low and a higher high at the end of the day. Because of this indecision, one of the best strategies is to Let The Market Decide at the moment which way it wants to go.

Yes, we can make arguments that we may have started a diagonal downward, as in ((A))-((B))-((C)) of a wave i, downward, and that the afternoon high is a wave ii, upward. But the upward wave may be completed, or it may not be. The jury is still out.

And, just like we can make an argument for a downward diagonal, we can make a good case for a triangle pattern, too, that might lead to higher highs.

So, watching those fractals for a bit might be an excellent strategy. If the first down (red) fractal back is broken it is only of minor significance because until the morning low is broken, a FLAT wave could also occur - still making new highs eventually.

Fractals are the location where the markets make decisions. You can try to out-guess them if you want. That is up to you. But remember where the daily bias is pointed. And if you chose to fight it, then at least recognize clearly you are fighting that bias, and it is you that decided to.

Otherwise, although today is known as a "hanging man" candle day, there is no confirmation of that candle until a new daily low is made. Isn't it interesting how that fractal at ((C)) and the confirmation of the hanging man would likely be at the same place??!!

Also, keep in mind that if a diagonal downward takes place, it could have two forms: either a contracting diagonal or an expanding one. And, typically, if the third wave lower is in the contracting form, then it would be shorter in time, while if the third wave lower is in the expanding form it would be longer in time - another excruciating drip-drip-drop.

But, further, looking at daily seasonals, since Tuesday is often (not always) a turn-around day, then if there is a triangle into Monday, the prices could pop on Tuesday to then make a better full-reversal bar. Nothing like that exists on the daily chart yet.

So, be cautious, be careful, be patient, keep your wits about you. The volatility is difficult to deal with, and the wave count is only of secondary usefulness right now to outline some of the shorter-term risks. Hopefully, some clarity will be provided soon.

And remember, Ira does not recommend outright short positions until below the 18-day SMA. This is in order to get the wind at your back if at all possible.

Have a good start to your evening and your weekend.

TraderJoe

)%20wave%20or%20diagonal.png)