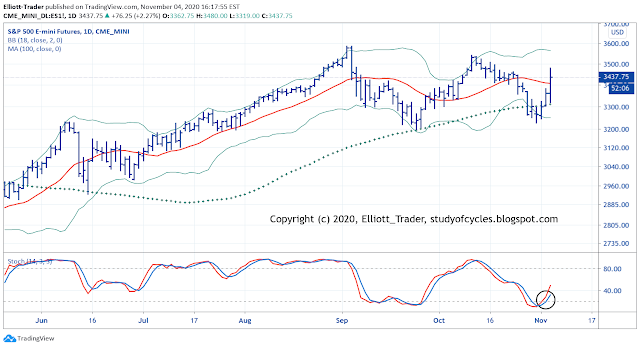

Many, many wave patterns can fit today's price action. It is probably best from a wave-counting perspective to remain flexible and not lock in on one just yet. First, here is the daily chart with the BollingerBands, 100-day SMA and Slow Stochastic.

|

| ES Futures - Daily - Positive Bias |

The futures this morning found support on the 100-day SMA, then rallied strongly over the 18-day SMA, leaving the price pattern with positive bias currently. Further, the daily slow stochastic has clearly turned up.

And here are some of the Elliott Wave Patterns that work at least unless the high is exceeded.

|

| ES Futures - Daily - Minute ((ii)) or circle-ii |

The above count is possible because minute ((ii)), or circle-ii, is shorter in price and time than the Minor B wave, upward, in the same direction. Obviously, this count would invalidate over the high of Minor B. We should note, that if this count plays out, then a series of new lows would be expected below the low of Minor A.

And this ..

|

| ES Futures - Daily - Flat or Failed Flat B Wave |

The above count is possible because minute ((b)), or circle-b, reached within 90% of the Minor A wave, down, as shown by the included Fibonacci ruler, and more so in the Dow. Also, minute ((b)) is shorter in price than Minor A, and may be the same or less in time.

And this ...

The above count is possible because the up wave can be counted as a zigzag, provided it doesn't extend again in the overnight or tomorrow. However, one thing not to like about this count - and the reason it is shown third - is that such a quick ((c)) wave would be uncharacteristic in a triangle. Usually, ((c)) waves in triangles are fairly long and complex.

And, yes, it is possible the (X) wave ended at the October low, but that still seems very, very short in price length.

If you are trying to count these waves, it is truly a difficult task, so I appreciate what you are going through.

Have a good start to the evening,

TraderJoe

Thank you very much for the variety of alternate counts. Your posts are always so educational. The momemt is very interesting. Opinions totally opposed, very bullish and very bearish, can be read on the Internet.

ReplyDeleteJG, it helps me by remembering "b waves are fake."

ReplyDeleteAlthough it is a puzzle how they can last so long but I believe the Central Bank "participation" or "manipulation".

Was the rally too big to be A of ((c)) in the triangle, with deep B and smaller C to come?

ReplyDeleteIt is already just over 78.6%; so the odds favor it is too big for another leg up within a triangle. Not impossible, but not high probability either.

DeleteDaily ES slow stoch. in overbought territory.

ReplyDeleteVery very good post TJ! Thanks a lot!

ReplyDeleteWelcome Luc.

DeleteUncanny how predictable these runs between round numbers are! It will be interesting to see if 3500.00 proves reistance.

ReplyDeleteGood morning all. The market is back to it's usual tricks - wedging and diverging on the hourly MACD. Watch for overlap at 3,480 which may provide some clues to the local count. Best wishes to all.

ReplyDeletehttps://invst.ly/sq7us

TJ

Good Morning- TJ you thinking 3480 is top of 1 and overlap would be C of 2?

ReplyDeleteHi fibo ..see below @ 12:43.

DeleteTJ

All the cash indices have a nice 5 wave channel up from the low that probably completes very soon.

ReplyDeleteLooking at the futures again, there is a big X wave around the election with zigzags before and after. On this side of the X, C = .618 * A right near 3530 and would fit right in the cash channel.

DeleteYes. If it is a C wave we close below 3500.00 in the cash session or if not see an impulsive surrender in ES.

ReplyDeleteAll impulsive waves up..down moves correctiv so far

ReplyDeleteGenerally waves that move up like this with little or no correction are C waves. I would not be in the least bit surprised to see the entire move re-traced as the upward monentum is unsustainable. Look for news...

ReplyDeleteThe ES 15min chart suggests that a 'last-chance' fourth wave, iv, is still possible; or a diagonal if there is overlap (but it would have a very long third wave in time compared to the first wave). See where the EWO is above 0.

ReplyDeletehttps://www.tradingview.com/x/EuzAHavJ/

TJ

And wave iv 'could be' a running triangle. It has the 'classic' 1.618 external retrace of the ((A)) wave for the ((B)) wave. Don't invest too much into it emotionally.

Deletehttps://invst.ly/sqbk2

TJ

..this up leg is now to 78.6%, and just a bit beyond. Remember, too, a "running triangle" could morph into an ending-diagonal, but a higher high would be needed first.

DeleteTJ

15min - observations

ReplyDeletehttps://funkyimg.com/i/38s32.png

From CNBC -

ReplyDeleteFed holds interest rates steady near zero, says economy is still well below pre-pandemic levels

TJ

fyi - the 'minimum' legal running triangle has been attained.

ReplyDeletehttps://invst.ly/sqdb-

TJ

Just wondering: Isn't it odd, and is it allowed for B, C, and D to be larger in price movement than A in a contracting triangle?

ReplyDelete..that's why the 'or failure top', but in an up trend, you count with the trend as your friend until it is not.

DeleteI think the B-D trendline just needs to be horizontal or nearly so.

DeleteFor a RUNNING triangle, that is.

Deletefyi - better proportions for a triangle now; or done.

ReplyDeletehttps://invst.ly/sqdl2

TJ

..no clear decision by the futures settlement, but price closed over the center line of the potential triangle.

Deletehttps://invst.ly/sqdx9

TJ

Update to prior chart (if interested).

ReplyDeletehttps://funkyimg.com/i/38shK.png

I think it's and expanded diagonal from top on ES

ReplyDeleteTerminal ES 3458

ReplyDeleteTraders appear to expect 3500 to hold on a closing basis and a second close above just might prove them correct based on past price action. This would bring 3600 into play imho...

DeleteGood morning, all. Here's the updated ES hourly. One level of overlap has occurred. Even if there should be a higher high, it would be on a 'whopper' of a divergence from the hourly MACD.

ReplyDeletehttps://invst.ly/sqrie

TJ whats your main count on this recent up leg?

ReplyDelete..see below @ 2:58 PM.

DeleteVIX suggesting a high not yet in place...

ReplyDeleteA look at the 4hr.

ReplyDeletehttps://funkyimg.com/i/38t2y.png

I wonder if it's a expanding diagonal on cash as well currently in iv

ReplyDeleteMy best try on spx, 2.618 is "common" on ext 5th?

Deletehttps://invst.ly/squ3j

Just clarifying prior post (earlier incorrect version was published; fat thumbs).

ReplyDeleteUsing the ES futures, there is a fairly strict (c) = (a) at the moment, which seems a lot more realistic than a 2.618 x 1, which is often a degree violation of some type. Also, I have noted a key overlap on the futures.

https://invst.ly/sqvoq

This count is good until or unless the prior day's high is exceeded higher.

TJ

This is also a plausible option?

ReplyDeletehttps://invst.ly/sqwds

Yes, but at the present time, there is no evidence for 3. So why is 1 preferred over A? There should be no preference at this time.

DeleteA new post is started for the next day.

ReplyDelete