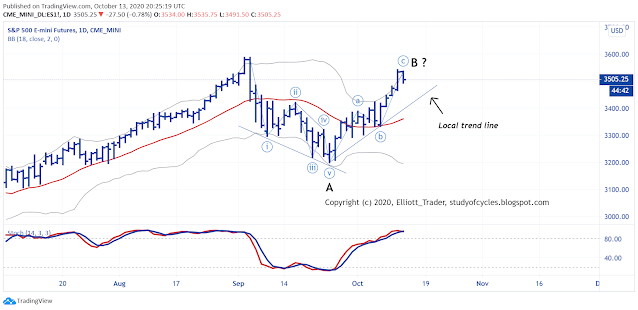

Yesterday, we said the probability of staying over the upper Bollinger Band today had roughly dropped to 3 - 4%. Today closed back inside of the band.

|

| ES Futures - 1 Day - Back inside the Upper Band |

If price continues to drop, this could be an excellent location for the Minor B wave. A good sign of confirmation would be trading below the local up trend line - shown - from A to minute ((b)). One issue is that the daily slow stochastic is likely embedded. So, another good sign of confirmation would be the red line of the slow stochastic trading back under the 80 level.

Have a good start to your evening.

TraderJoe

There are two things that makes me thing something else is up. Correction 3 waves so far and and move down was 23 fib. Could we be starting the 5 th wave up

ReplyDeleteI think that is correct. Move down looks corective and failure to breach 3500 decisively points to higher prices short term. Price action around these roind numbers has beeen quite remarkable in charting price direction!

DeleteHere 's a slightly larger channel for the two of you. You may, of course,

Deletebe correct in your opinions or your thoughts. I try to base mine on procedure. I do ask you to consider that not all 'moves off the top' start with a bang, as shown in the example in the lower left. Sometimes they grind lower - as in an overlapping series of 1,2's or a diagonal, and then the range expands.

https://invst.ly/sge7g

Anyway, I'll follow procedures until someone can show me why not to.

TJ

Yes lets see. Btw TJ i have a question will appreciate if you can help. Can the 4th overlap with the expanded B wave of 2..or that's not allowed. Thks

ReplyDeleteLooks to me like flagging price action T.J.I agree that nested 1,2s can start down-trends. I think it is also true that technical extremes due unprecedented market support is posing quite a challenge. Two obvious examples are price continuing higher in the face of clearly broken long term trend-lines many weeks ago, and price and volatility in directional unison.

Delete@jack .. show me a place where it does (chart link?) for context and I'll see if that's the case. Otherwise, I prefer not to deal in hypothetical.

DeleteIf I may answer. This was addressed explicitly by Elliot. And the answer is yes.

DeleteBecause the Top of 1 (in this scenario)would be an orthodox top. and if 4th comes into the territory of expanded B- its still valid and good.

I would prefer to see the real example to insure that a) a diagonal is not missed - either contracting or expanding, b) that the other wave measurements of a true impulse are adhered to, and c) that there are no degree violations in the wave under consideration.

DeleteTJ

Thanks. I am not looking at any particular count. Was just curious if 4th is allowed to overlap with expanded B or is that a violation in elliott wave world.

DeleteOpening cash SPY gap closed in first hour.

ReplyDeletehttps://www.tradingview.com/x/UxdWwUV4/

TJ

ES and SPY new lows downward.

DeleteJoe, I asked a pivot point question a week ago or so but wanted to run an observation by you. I know you indicated a preference to the futures. Since that time I have been observing and am noticing that the market seems to respect and react to the futures pivot points more reliably than the cash pivot points. Are you in agreement with that or is it just a short term coincidence applicable only to the current time period?

ReplyDeleteAs I have said before in reply, the cash S&P500 is a calculation only. And the pivots on it are a calculation on a calculation. The futures represent real trading, and make ranges the cash markets do not. The pivots on the futures are thus only one level of abstraction. The pivots on the cash are two levels of abstraction.

DeleteTJ

What you are saying didn't quite sink in before but I think I've got it now. The futures are actually traded as a vehicle where as the cash is a composite of other vehicles which create an additional level of removal from the action.

DeleteOne thing we can tell for sure .. if SPY trades below 347,05, it could 'not' qualify as a diagonal, and might go on to make a 1-2-i-ii impulse lower. That's because it's third wave would be longer than it's first wave.

ReplyDeletehttps://www.tradingview.com/x/SaBZbFeC/

Only reason a contracting diagonal comes up is the trading still seems quite slow. However, the EWO on cash is giving some indications of a third wave instead.

TJ

ET, do you see leading expanding diagonal as 1 of C down?

ReplyDeleteI sure do. https://www.tradingview.com/x/3WdjROgL/

DeleteCould also be some sort of confusing nested 1-2s?

Delete@Steven .. your leading diagonal 'may not', by rule, contain a flat second wave. There may be other diagonals involved.

DeleteThanks Elliott!

DeleteLets see if this plays out.

ReplyDeletehttps://imgur.com/bt8Vr5j

Another possibility from today high.

Deletehttps://imgur.com/BSN9mSm

When I don't know yet, I say so. I'm saying so, and also showing this failure wave possibility.

ReplyDeletehttps://www.tradingview.com/x/dcFODji9/

If the failure is not considered there may be some degree violations downward.

TJ

Just taking a different view i can read the down move as abc..5th of c being really extended in futures

ReplyDeleteI think its working down on a 3rd wave down of C

ReplyDeletehttps://www.tradingview.com/chart/gabxw6yl/

NQ futures stopped near the 1.618 Fib. I think so too

DeleteThis comment has been removed by the author.

ReplyDeleteWhat about this impulse from top ??

ReplyDeletehttps://invst.ly/shl6k

Man, I hope Joe is all right.

ReplyDeleteAs far as I can tell, this is the first time (ES Hourly), that an expanding diagonal may be rigorously considered. That is because at this time each of the required legs may be seen as a zigzag, and not a Flat wave.

ReplyDeletehttps://invst.ly/shqpl

Please, please, please recall these are 'low probability patterns", and they must prove themselves in every detail.

TJ

Your speculative reads are always appreciated. If it does play out, are there special rules or guidelines that apply to retracement of an expanding leading diagonal?

DeleteA new post is started for the weekend.

ReplyDelete