Make no mistake, there are a LOT of people on the Internet, amateurs and professionals alike - many of whom partially or completely ignore degree labeling - who are looking for a clean "five-up" from the 23 March low of this year. As you know, this site tries not to ignore enforcement of proper degree labels. With that in mind the close-only chart below shows what I believe to be the best chance for those who want to see "five-up" to get it.

|

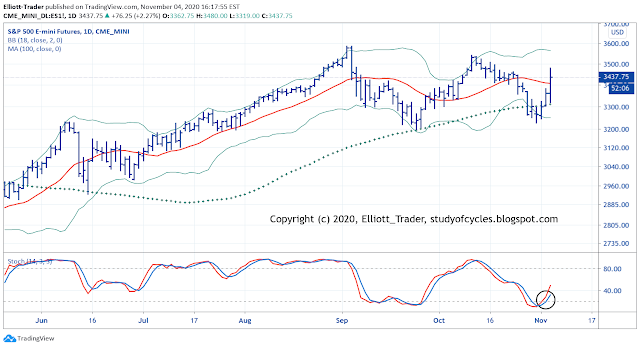

ES Futures - Daily Close - Wave in a Wedge

|

The key to this analysis is that the Sep - Nov correction is the largest correction in price and time, as noted. There just is no disputing that measurement. So, with that in mind, and the fact that the Dow made a clean A-B-C down into the October low, this should mean that this correction is at least of the same degree as the first minor B wave down to the end of June, or it is of one larger degree. It is my considered opinion that since the first A wave down in September is longer in price than the Minor B wave down in June, and because the correction takes so much more time, that the wave is of a higher degree, an Intermediate degree wave.

As such, if the first three waves up are A,B,C to a (W) wave, then the down wave can be an Intermediate (X) wave. But, if the first three waves up are the very same A,B,C to an Intermediate (1) wave, then the correction to the October low could be three-waves down to an Intermediate (2) wave of a potential diagonal.

We have already cracked the high since once. This could be a Minor A wave of wave Intermediate (3) of such a diagonal or it could just as well be to Intermediate (Y) of a double or triple-zigzag. Before going on too far, it should be realized that one reason not to like the above count for a diagonal fifth wave is that "most-often", "typically", not always, diagonals have much larger retrace waves in the area of 50 - 85% retraces. This retrace is less than 38.2%! This is noted on the chart.

Also, noted is that any downward wave must stay above the wave (2) or (X) low, for a diagonal not to be invalidated. It can not break it by even one tick in the futures market. Sorry, but this is a hard and fast rule. This is noted on the chart too. In such a chart, it might be difficult for some to distinguish between the triple zigzag count of a Primary ((B)) wave, or the three zigzags inside of an ending diagonal for a Primary ((5)) wave.

But now .. with sentiment having flipped very bullish most recently, what if the wedge breaks? Then there is an way for the Intermediate (X) wave to extend in price and time, as below.

|

| ES Futures - Daily Close - Wave Breaks a Wedge |

There are three roughly equal possible wave counts that would agree with degree labeling. Which will occur? Sentiment seems to favor the larger (X) wave, but we can not rule out the other two in the first chart. The only purpose behind this post is to correct what I think are incorrect degree labels by others studying the waves, and to provide a "face-saving" way to get the five-up with correct degree labeling.

So stay tuned, and ...

Have an excellent rest of the weekend.

TraderJoe