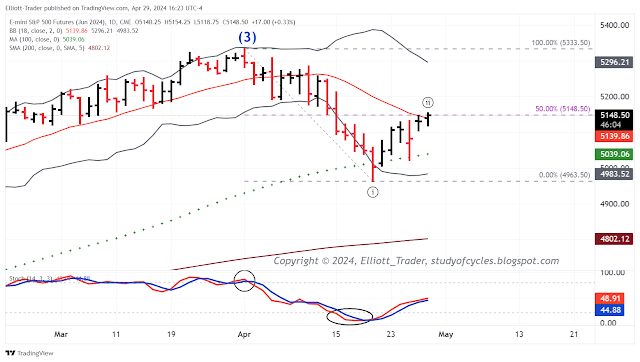

Based on the count in the DJIA cash (and near contract futures), the count to the Minor C wave and the Intermediate (3) wave is likely over. The minute second wave trend line, from the extended first wave, was broken and resulted in a shorter third wave, triangle fourth wave and even shorter follow-through fifth wave, as per the daily chart of the futures, below.

But as simple as the next down wave might seem, it could be a real mess - especially to trade. Remember, if we are making a Primary ⑤ contracting ending diagonal, then Intermediate (4) must turn out to be an Intermediate degree zigzag, lower. That means that Minor wave C would likely end lower than Minor wave A. And fourth waves of any type can be difficult at the very least. But the chart below expresses just some of the many complications that can occur in this wave. So, let's get into it.

Starting on the left, the Minor A wave down - which must occur in five waves - can either be a rather standard impulse in total - or it can be a leading diagonal in total, either contracting or expanding. But worse, being a Minor A wave, it could start with a minute ⓘ wave as a diagonal, and then convert to an impulse for the second, third, fourth and fifth waves of Minor A. So far, in the ES, the pattern is very overlapping and might be a diagonal wave, possibly expanding, but this could still only be the minute ⓘ wave of Minor A.

If that isn't messy enough for the Minor A wave, it could be the Minor B wave that really throws some twists and turns into the picture because a B wave can be "any three". To make the point more graphically we have shown many of the 'most common' variations of the B wave, above. For example, in the upper left pane, the B wave could be a zigzag or a multiple zigzag. Even if it is a simple zigzag, either of its motive waves - but not both - could be an impulse or diagonal. But there is no reason the zigzag couldn't double or triple, as well.

Next, in the upper right panel the Minor B wave could also be a Flat. This is the most difficult start-stop pattern as it will throw off numerous traps. Yet, further, the Flat family can include double-combination waves, and/or less-commonly triple combos.

Third, the lower left panel shows one variation of contracting triangle, the "running triangle". But the wave could also drive one crazy as either a regular or barrier triangle, as well. Each would be a contracting triangle, and the barrier version might also be confused with a Flat wave - as above.

Fourth, in the lower right panel we show the possibility for the expanding triangle, as well, though this is less common.

Fibonacci Fifth, one must keep in the mind the possibility that the Minor C wave could be an impulse or diagonal as well - to alternate with the form of the Minor A wave - and that either the last leg in such a diagonal might truncate slightly or that all of the Minor C wave truncates ever so slightly.

In sum, this wave could be a feast for the algos. So, if you are personally getting excited about huge, and large waves down, my recommendation is do not get overly worked up. As you saw on Friday, retraces can be very, very deep, and difficult to call. And the down waves can be halting start-stop affairs which test the patience in the first place.

Remember, in the contracting diagonal Primary ⑤ count, all that is required to happen is that the 4800 level, the high of Intermediate wave (1) needs to be overlapped in zigzag form. That is just not all that far, lower. And, yes, price can go considerably further down, but one needs to be aware of how compressed the pattern 'could' turn out to be.

Now, if you are looking for broad, swift and dynamic waves lower, then you are looking for the likelihood that this Intermediate wave (3) is actually Intermediate wave (B), up, and an Intermediate wave (C) down is to follow. That is possible as the alternate. I am taking the most conservative route here in a correction. But there is absolutely no sign of such a dynamic wave down based on the start of this wave down in the ES. One might argue that the Dow is falling faster. So be it. Still, the only sure way to call the difference will be if the Intermediate (4) wave invalidates at some point. We are nowhere close to that, yet.

Wave-counters should place a "wave-counting-stop" at the prior all time high as this would indicate problems with the diagonal count. We will lower this stop periodically while counting the Intermediate (4) wave, lower. And, when the Minor A wave is done, we may have to raise such a stop in order to allow for deeply retracing Minor B waves. They could easily go to 78 - 80% of Minor A.

It is my hope this post calms you down by showing you the complexities that can be faced. If you are calm by nature and treat trading more like just a fun business, you have more of the right attitude for success. For newer traders, this wave might provide really good opportunities to forego pressing the buy or sell button and learn the intricacies of counting waves instead - while the algos drive others crazy. Or turn to other assets to trade temporarily, if this fits your situation.

Have an excellent rest of the weekend,

TraderJoe