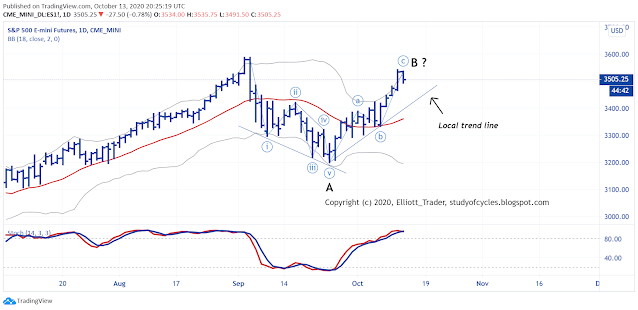

Today, the last trading day of the month, we were following this potential ending diagonal as the futures first traded significantly lower overnight, and then began what seems to be the continual intraday grind.

We cautioned that people should be very careful with this pattern, and when price was below 3,250 at 3,240, we said that a wave ((4)) at 3,250 was possible, but that it was the max. If that price (3,250) was exceeded higher, it could mean that the low was on the prior low. That is how it turned out. Prices shot up into the close as another reader (Tjchuck) had reminded all, that the first of the month - with expected possible inflows - was just around the corned. The result can be seen above.

With about 183 candles on the S&P500 30-minute cash chart, the failure gives us one way to count the five-waves-down into a minute ((i)) wave as follows.

|

| SPX Cash - 30 Minute - Minimum Minute ((i)) |

The failure would have ended only the fifth wave of wave (v) - which is not outrageous for a truncation. The wave itself would not have failed to make a lower low that minuet wave (iii).

But, there is another wave to consider the failure, as well, and that is a part of a running triangle for a wave (iv) still in progress. This might make some sense given the looming election scenario. So, I'll show that with fewer bars on the hourly chart, as below.

|

| SPX Cash - 30 Minute - Larger Minute ((i)) |

This second pattern might provide better alternation between waves (ii) and (iv), so it really is hard to rule it out at this point.

And again, with the election immediately ahead it is best to be patient, calm and flexible at this time.

Have a good start to the evening.

TraderJoe