Market Indexes: Major U.S. Equity Indexes closed higher; RUT lower

SPX Candle: Higher High, Higher Low, Higher Close - Trend Candle

FED Posture: Quantitative Tightening (QT)

All day today the market made a series of overlapping waves. About 11 AM we said a contracting diagonal could be forming on the intraday chart. As a result, there is no change to the count.

|

| S&P500 Cash Index - Hourly - Overlapping Waves in a Wedge |

Have a good start to your evening.

TraderJoe

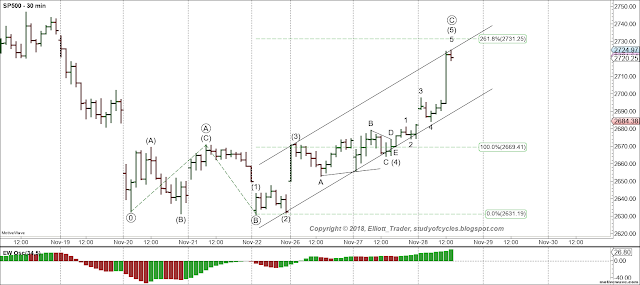

P.S. Here is an up count on the current wave that does not violate degree labeling. All individual waves within (5) must remain shorter than (3), and they currently are. This is the half-hour chart.

|

| S&P500 Cash Index - Half-Hour Chart - Potential Expanded Flat |

thanks joe

ReplyDeletewelcome Marc.

Deleteand quick question... why do you expect such a small X wave in terms of price and time? is it because of the channel? if we put the channel aside are there any rules/guidelines for X wave of WXY double zig zag?

ReplyDeleteas always thanks in advance

and looks like we may break upper limit on diagonal in futures will have to see in morning on cash.

Delete'Such a small' is an opinion. We already known it is the largest up wave in time. That is a measurement based on the number of bars that any person can replicate.

DeleteThe futures had a first spike higher in the overnight as P_Tom noted. Futures may have their own measurements different than cash.

DeleteWhat might the ramifications be of a significant break of the upper channel boundary?

ReplyDeleteWould have to conclude the C wave down ended on the three lower lows as a diagonal. But, it's ugly.

DeleteJoe, I like your idea and I'd like to see a higher open with close on the low. A 1 3 bar. 13 day ema is about 10 points or so.

ReplyDeleteJoe, what about a zz for the X wave on futures? X waves as triangles are less common?

ReplyDeleteThanks!

Why can`t wave b of your x wave be the low and we are already in wave c of the flat? 90% level was nearly hit and seasonality/turn of the month is bullish for the next 4 weeks.

ReplyDeleteI think "nearly" isn't 90% - and 90% is the minimum required, but I'm definitely not the expert!

DeleteIn the futures market the 90% level was missed by 2 points over thanksgiving and there was a new low at that time.

DeleteThe best alternate count - which would only be activated after crossing 2,747 (cash) - would be a double-zigzag up. Since, the 90% level down was not made, there is nothing to prevent the up count from being W-X-Y where W is three-waves up to 2,815; X is down to the 2,631 low, and then there would be three more waves up for the Y wave.

DeleteNext best count: diagonal is all of 1, gap up is 3 or part of 3. Down move today is 4 or ii of 3. A five-wave up move could still be the 'c' wave of X.

ReplyDeleteMarket gaps and stalls so badly, it makes counts subject to a high degree of error at this point. What is needed is a) overlaps, b) confirmation and c) possibly trading back within the channel to suggest anything lower.

Not Elliott based but was thinking that everyone is so obsessed with the G-20 that we may drift for the rest of the week before volatility resumes. Now that I've put that out there watch the market take off in one direction or the other! LOL

DeleteGuess I forgot about powell's speech. LOL

DeleteUp move creates degree violations unless the center section (yesterday's proposed diagonal) is an overlapping fourth wave triangle.

ReplyDeleteNow five wave up in a clear channel with extended fifth wave sequence. For the possible expanded flat, then 2.62 x A + B = 2,730.83

DeleteTerminal of potential triangle? 2665?

DeleteI have posted the half-hour chart that does not contain degree violations as a post-script above.

ReplyDeleteThank you!

DeleteThank you, Joe.

DeleteThanks Joe, I think the last wave within (5) is NOW longer than wave(3). Is that accurate?

ReplyDeleteNot sure what you are getting at; (5) is the extended wave in the sequence and each sub-wave is smaller than (3).

Deletejoe

Deletei must let you know excellent work on your behalf. By removing the 1212 nest to downside you opened door to accepting market needs put in work to upside. Whether your count is going to change is irrelevant as far as your contribution thus far. I think its now in 3/3 off bottom with first move a diagonal as i mentioned yesterday. Thanks again

Thanks for responding. I know exactly what you mean but the last sub-wave of wave (5) from 2684 which you have marked as wave 5 to complete wave ((c)) is larger than the whole of wave (3)

DeleteV . thats ok. Each bar is less in length. That's how the extended wave in the sequence becomes the extended wave; each sub-wave, each bar, is smaller.

DeleteMarc .. just fyi, the diagonal wave i scenario created a degree violation with the length of the first sub-wave in the sequence. And, if the whole first wave to the diagonal is the first sub-wave it is longer than the ((A)) wave, which also created a degree violation.

Delete..and thanks.

So your 0 point on the postscript chart would be subminuette .w and the possible expanded flat would be subminuette .x - then .y down to complete minuette (b) down- Then then minuette (c) up to complete minute((2)) up?

ReplyDeleteIt is plausible. Let it prove itself.

DeleteThank you, yes. Just trying to keep degree labeling straight.

ReplyDeleteSo far, the 'big boys' just missed the gap fill at 2,736.27; I 'only' use the close-to-open gaps. I do not use the low-to-high gaps. I would keep an eye on the mid-line of the channel shown above. Trading below it would likely signify 'at least' a corrective wave in progress. I'll be taking the rest of the day off.

ReplyDelete