Market Indexes: Major U.S. Equity Indexes closed higher

SPX Candle: Higher High, Higher Low, Higher Close - Trend Candle

FED Posture: Quantitative Tightening (QT)

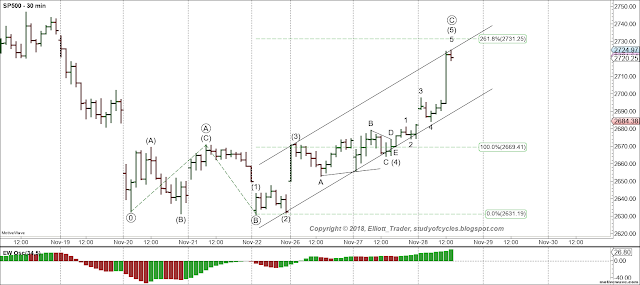

Today's post is occurring in two parts. The first part shows the S&P500 Cash Index chart - close only - using five minute closes to simulate one of Neely's techniques for wave counting. Besides simulation, we think this view can provide unparalleled insight into the nature of this wave, and wave counting in general. Yes, using 5-minute closes might leave out a data point or two, but, yesterday, we used the hourly futures with every data point included, even overnight ones, and one can arrive at a slightly better count by using cash chart.

Further, we know we verified all of the degree labeling requirements on the hourly futures. So, we will not dispute those in this chart. The main purpose of this chart is to show the form of the wave, without a lot of the distractions from the bars.

|

| S&P500 Cash Index - 5 Minute Line - Neely Style |

The first thing we notice about cash, is that where it was possible to call wave ((2)) a sharp in the futures, this is not possible in cash.

Why?

This is because of the Neely guideline that a line from zero to wave ((2)) must not cut off any part of a wave ((3)). Showing wave two at almost any earlier location would do that. And, at this location, wave ((2)) overlaps wave ((1)) as required for wave ((2)) to be "corrective" to wave ((1)).

Wave ((2)) thus becomes a "running wave" with a higher (B) wave, and that is important. It means that wave ((4)) should only be a 'short sharp' or a longer triangle. If the fourth wave were to become longer than two in time, then it would have to be a triangle. But, keep in mind this is an a wave up, overall. As such, it can throw a wrinkle or two into the impulse. It doesn't have to but it can. The wrinkle would be that that fourth wave is shorter in time than the second wave for it's alternation. This is the real discussion of alternates in wave analysis. In either case, the (B) wave of ((4)) should not cross over the top to alternate with ((2)). As the chart shows, it didn't.

The second part of this post consists of reminding us that the daily ES price is still over SMA-18, and therefore still has a positive bias. There is some potential for two things over the weekend: a) the results of the G-20 meeting. If negative, they could temporarily bring a down draft. If positive, perhaps a gap up. b) Monday will be the first day of the new month with the usual potential for inflows into the market, as we have written about many times before (company bonuses, dividend reinvestment plans, 401k's, etc.). If G-20 is positive and inflows occur, and a gap up results, then there is an alternate count here where ((1)) and ((2)) are actually ((A)) and ((B)) of the (y) wave upward to minute ((ii)).

That latter interpretation would be the ((A)) wave as a Leading Diagonal.

There is nothing that says that wave ((5)) in the above chart is done either. It could be but it doesn't have to be.

Take it easy. Rest up. Have a good start to your evening and to your weekend.

TraderJoe

~~~~~~

P.S. In trying out the ALTERNATE count of A, as a diagonal at the bottom, and B the very brief retrace, it creates a degree violation that 1 of C, at or near any of the peaks of the high, which would be a sub-wave of lower degree than A, yet it would be longer than A in price, which does not work. Good news.

1 of C (in the ALTERNATE) would have needed to be located near one of the highs because the potential gap up would be a iii of 3 of C.

Bottom line: best count at this time is a five wave move from the bottom, most likely as an A wave to Friday's high.