THEN:

|

| German DAX - Weekly - Posted Jan 11, 2018 |

Although there was some slight down movement at the time, prices had not broken to a lower weekly low yet. Clearly by the lines drawn on the chart, a prediction was made that there would be a lower weekly low, and a larger wave (4) which would attack the lower channel line and likely terminate in the area of a prior wave 4.

Here is the updated chart.

NOW:

|

| German DAX - Weekly - 02/25/2018 |

So far, wave (3) is slightly above the channel to show the portion of the wave with the greatest momentum, as typical, and the decline has appeared to stop at the prior wave 4. That being the case, Elliott suggests we redraw the channel slightly so that is is now touching waves (2) and waves (4) at the bottom edge.

Any weekly higher highs will suggest the fifth wave (5) is in progress. And the first target for the move will be the mid-point of the channel (as always, not trading or investment advice). Should price exceed the mid-channel, then look for the current upper channel line.

And, if price exceeds the current upper channel line, then, it, the upper channel line, will be re-drawn so that so that it is parallel to the lower channel line but touches on (3) rather than (1).

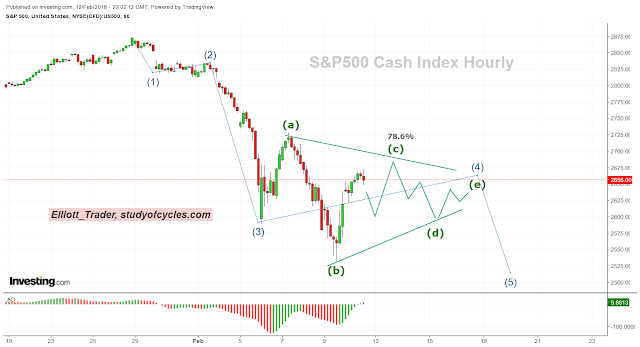

As with all Elliott wave scenarios, this one is probabilistic too. There is some chance, likely a small one, that wave (4) could better define itself with a lower low. And there is some chance, also likely a small one that wave (b) is the high in a wedge-shaped wave. There is also a not-so-small chance that wave (4) could go on to form a triangle with the current wave (4) only being wave (a) of the triangle, and the prior interior (a) &(b) waves being demoted by one degree to a & b.

But at this time, the above wave channel has the right look, and therefore has the greatest odds of playing out in one fourth & fifth wave combination or another. The Fourth Wave Conundrum occurs at every degree of trend, and there is nothing one can do about it due simply to the large number of ways that fourth and fifth waves can form. Yes, we must remember the fifth wave could impulse, but it could also form a grinding diagonal, as well.

There is also no requirement that the fifth wave 'must' make a new high. If we are at the end of a longer wave cycle - like a SuperCycle - wave (5) could certainly truncate, if it wishes, and stop short of the all time high. So, as usual, one must take it a step at a time and not get overly-enthusiastic on one path or the other.

Cheers and enjoy the weekend.

TraderJoe