Market Indexes: Major U.S. Equity Indexes were higher

SPX Candle: Higher High, Higher Low, Higher Close - Trend Candle

FED Posture: Quantitative Tightening (QT)

From the weekend post, we were expecting some modest up movement. That did occur today. The potential count of a downward diagonal on the Dow which we showed last Friday) did not invalidate on the Dow. But it did invalidate on the S&P500, and it's Elliott Wave Oscillator signature on the Dow is not correct. So, we consider that count dead.

To be objective, the only count we see that allows the market to revisit the highs and make a minor wave 5, is that we are currently in a Minor Wave 4 triangle. Here is the reason for this based on charts we posted today in the live chat room. It is something that likely few others noticed.

|

| S&P500 Cash Weekly - 2018 Exceeds 2015-16 |

The whole down turn so far in 2018 exceeds in points the number of points of the down turn in 2015-2016 which is Primary ((4)), as it is currently measured. As you know from the very definition of the term degree, you simply can not have a smaller degree wave, say Minor 4, exceed the larger degree Primary ((4))th wave in points. It violates the definition of the term degree.

This also must rule out an Intermediate wave (2) of a larger contracting diagonal. Because neither can an Intermediate Wave be larger in point size than the Primary Fourth wave.

The only way I know of for the market to potentially correct this situation is for Minor wave 4 to become a triangle. As I understand it, because triangles are measured from wave 3 to the triangle's wave (e), then it is possible this wave could have measurements smaller than 2015 - 2016, but only if a contracting triangle is formed, and if it starts as a clear zigzag. If it doesn't do this, then the upward count is over and ended at the highs as far as I can tell.

Again, a triangle must start with a zigzag downward. If this wave turns into a full-on impulse, downward, then the upward triangle is dead, and we are likely headed much lower. As of today, the odds stand at about 45:55, upward triangle versus downward impulse. Here is why.

- There are still two (actually three) ways to count a downward impulse

- There is one way to count an upward triangle

|

| S&P500 Cash Index - Hourly - Downward Impulse Completed, A Up |

In this case, then wave (5) = 0.618 x net [ (1) through (3) ]. There is nothing wrong from a 'rules' standpoint with a wave like this. The only concern is that wave (4) is quite large and disproportionate compared to wave (2).

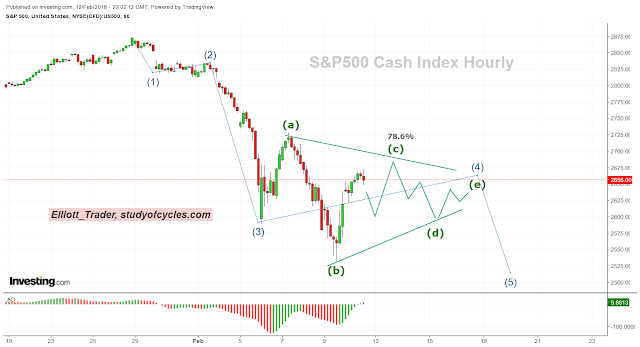

The second way to count a downward impulse, is as an impulse with a wave four "running triangle" still in progress. That count would look like this. For this count, it would be best if wave (c) held the 78.6% level of the retrace on wave (a).

|

| S&P500 Cash - Hourly Running Triangle (4)th Wave Incomplete |

The very purpose of this "running triangle", is to better equalize the net distances traveled by waves (4) and waves (2), and to keep the downward movement alive with it's lower (b) wave. Further, now that price has hit the lower weekly trend line, this would be a move that breaks that trend line and perhaps generates the real bearishness needed to start a 62% retrace.

So, those are the two most likely ways for downward travel to immediately continue.

Yet, for the upward triangle, instead, then the move would have to be counted something like this.

|

| S&P500 Cash Index - Three Waves Down in a Minor 4 Triangle |

In this case, one would have to count downward, A-B-C, where C = 0.618 x A; still a somewhat common relationship between the waves.

And, yes, this does make that third potential downward count. If A = 1, then there could be an upward FLAT forming wave 2 instead of a zigzag. And, perhaps that FLAT would end at the fourth wave of one lower degree.

Due to the extreme uncertainty in counting at this moment, from a wave-labeling perspective, it might be best to let a few waves "shake out" and see where they land.

Have a good start to your evening.

TraderJoe

Superb analysis as always Joe..this is why i follow you..you are one of the best analysts i've seen in my 20 year trading career...thanks for sharing you insights sir

ReplyDeleteWelcome Roger & much appreciated.

DeleteThanks for pointing out the degree issue, Joe. It's very helpful. As I pointed out over the weekend, while all of the cash indexes made a lower low on Friday, none of the futures did, except NQ. I also said that it's impossible to count the move from Wednesday's high to Friday's low as an impulse wave because there is no alternation in any of the futures indexes. (waves 2 & 4 would be mirror images of each other.) So Friday's low has to be a b wave. That means we could have completed a running flat today, or it could turn into an expanded flat, or a running triangle as you mentioned. The only upward alternative that I see is if 2872-2593 is an abc, 2728 is an x wave, and now we're forming a non-limiting triangle where 2533 was wave (a). That means wave(e) would end higher and solve the degree issue.

ReplyDeleteJoe, is the degree rule found in any of the EW books, or is it a "common sense" rule that you came up with? Also, as I was thinking about it, as the market goes higher and higher, the point totals of waves will naturally get larger and larger. However, the percentage totals won't get larger and larger. For example, 2872-2533 is larger in points than 2135-1810, but it's smaller on a percentage basis. If the waves were measured in percentages, then it wouldn't violate the rule. Thanks.

ReplyDeleteDon't go around in circles. The very first person to write about "degree" was R.N. Elliott in The Wave Principle. In chapters II, III and IV he explains what he means by degree. He says, among many other things, "the five waves of one dimension become the first the wave of the next greater dimension or degree." In other words, in order to make up that next wave, they must necessarily be smaller than it.

DeleteOk, but a few months ago you posted a possible expanding diagonal count from 1810, where the 4th wave was going to have to come all the way back down to approximately 2200 (I'm guessing on that number,) and that 4th wave of the diagonal also would have been much larger in points than the 2135-1810 decline. So how would that have been valid but the current decline is invalid (as it currently stands)? Thanks

DeleteHi Joe

ReplyDeleteThx for sharing

If you find some good EW video in the net pls let us know

I wish you would cover GDX. Thanks

ReplyDeleteHi Joe,

ReplyDeleteI can´t come up with any kind of bullish count on Transports after last weeks selloff on the weekly chart. But this doesn´t need to mean that s&p500 can´t do a 5th wave from here? Because S&p500 is a much more diversified index and not all sector collapses at the same time..I still see a 5th wave missing on XLF, XLK, XLY.

Thanks..Erik

I mean thats what characterizes the 5th wave of an index...a drop in breadth, momentum and volume..

Delete