In Glenn Neely's book, Mastering Elliott Wave, there are some statements which are offered with little in the way of clear, realistic examples for the reader to sink their teeth into. Having real price examples - which are largely not present - would be a great way, on the other hand, to build buy-in to the ideas and claims made in the book.

For example, there is one statement made in the book, in Section 5-18, on Flat waves. The following statement appears,

"When the b wave exceeds 138.2% of wave a, there is no chance the c wave will retrace all of the b wave (the c-wave of a Triangle might, but not the c-wave of a Flat)."

So, I decided to put this exacting - either/or - statement to the test with the most famous Flat wave I am aware of : that is the year 2000 - 2009 Flat wave in the Dow Jones Industrial Average. Here is the chart. Notice that Neely says "no chance". That means none in my head: i.e. it won't happen.

|

| DJIA Cash Index - Monthly - (B) Wave Flat |

As the monthly chart shows there is a three-wave sequence down to Intermediate (A), which is composed of an Expanding Leading Diagonal a wave, down. This is followed by a three-wave b wave, up, and this is followed by a five-wave c wave, down, to end Intermediate (A). The five-wave c wave, down, proves that the expanding diagonal was leading and not ending.

Intermediate (A), down, is then followed by a three-wave Intermediate (B) wave, up, to well-beyond the 1.382 Fibonacci external retracement on wave (A). In fact, the wave surpasses 1.500 and is very nearly at 1.618.

The five-wave Intermediate (C) wave, down, ends well beyond Intermediate (A) - meaning that Intermediate (B) is also completely retraced. We know the only way to have a five wave sequence down, and not make lower waves - which is hasn't - is to end a correction. So, as certainly as we might, we know this whole sequence is most likely a Flat wave.

And, by example, one can see that a statement which contains a categorical denial is disproved. Did Neely say, "for the S&P 500, only". No he didn't. Maybe it works in that case. It didn't for the Dow.

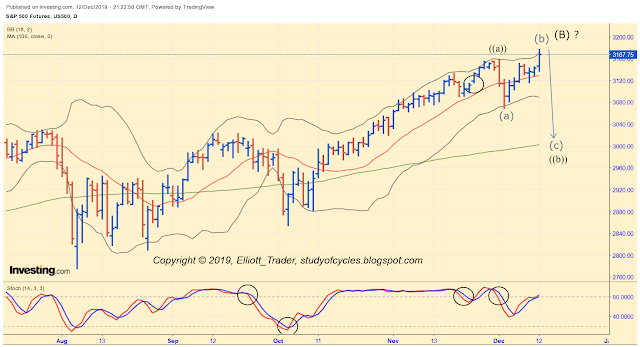

In the first instance, my purpose is to ask you to be a bit leery of categorical statements made regarding Elliott Wave for which an author offers few examples. In the second instance, I want you to note very clearly how long that (B) wave is in time! There are 60 candlesticks in that (B) wave, and, since this is a monthly chart, that means it is five-years long to a first approximation! How long in time is our current (B) wave? From Dec 24, 2018 to the present or just about only one year as things currently sit.

Have an excellent rest of the weekend.

TraderJoe

P.S. This chart was added after the original post and subsequent discussion. I thought it would be helpful to see "how large" a divergence occurred with the $NYAD at the 2007 top. As, you can see from the chart below, assuming this is a (B) wave, the initial divergence occurred on a prior high in price. Then there was a larger divergence before the ultimate price high.

|

| $NYAD - Weekly - 2007 Wave (B) |

Prior to the penultimate high however, the $NYAD was literally 'screaming' higher.