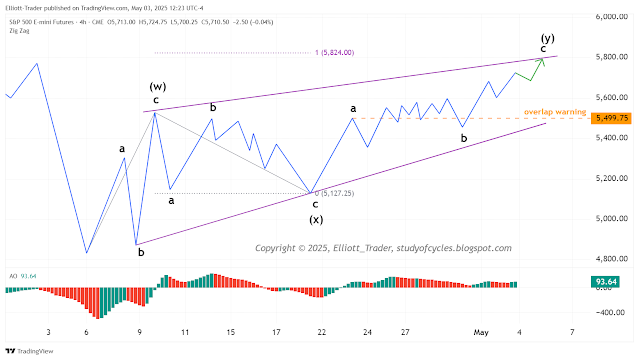

Over the last several weeks we have been counting this pattern that starts out with a three-wave zigzag. The ES 4-hr chart (using the zigzag indicator to simulate a Neely-style chart) is below. The pattern in the wedge has 113 candles now - very close to the range of the desired 120 - 160 for The Eight-Fold-Path Method. And in the comments for the prior post, we said we could see the overlapping wedge pattern potentially finished as either a contracting diagonal or a triple zigzag. For the moment, there is no point in labeling the pattern until price significantly breaks the lower wedge line. One item to note is that in the potential diagonal count - as we noted in prior comments - nothing has invalidated as of this time.

|

| ES Futures - 4 Hr - Wedge |

I know you don't want any problems counting waves, but they do exist. One of the biggest ones is in knowing whether a movement is over or not. And we don't know upward movement is over. So, therefore we could also envision an alternate where this leg up extends until, say, Tuesday. If so, then the wedge might expand to make a wider wedge - more towards a channel - and a slightly different count could operate. That count is below.

|

| ES Futures - 4 Hr - Larger Wedge or Channel |

So, once again, we are in the position of counting very locally until we see if/when we can differentiate between the two counts, even though the first one is preferred at the moment - primarily so that the recent waves don't become too long in time.

A very significant down move on Monday night and follow-through lower might indicate the first pattern is the correct one.

Have an excellent rest of the weekend.

TraderJoe

Assuming the diagonal is complete and the typical deep retrace does ensue, what I am wondering is if there is anything technically that militates against it's being of the leading variety...

ReplyDeleteThere is none in the ES that I see, but, but, but .. in the Dow (YM) it really doesn't look like it has the requisite five-waves-up, yet because that fourth wave would be absolutely miniscule. TJ.

DeleteAgreed! That remaining open overhead gap beckons...

DeleteJoe, if it’s gonna form a triple zig zag shouldn’t it be in a parallel channel? I realize if so it hasn’t developed yet. Thanks

ReplyDeleteThree items here: first, 'any' contracting diagonal - this one or others - proves that three zigzags do not always have to be in a parallel, right? Because a contracting diagonal is always composed of three zigzags in the motive direction. Further, 'any' expanding diagonal proves that three zigzags do not always have to be in a parallel, because the expanding diagonal is always composed of three zigzags in the motive direction. So, use these two proofs to disabuse oneself of any 'rule' that three zigzags have to be in a channel.

DeleteSecond, yes, there are a lot of examples of three zigzags in a channel - often B waves. So, 'sometimes' triple zigzags channel and channel perfectly well. Not always.

Third, if the above structure goes on to form a channel, there is some probability - as shown in the lower chart - that it will just be for the 'double' zigzag per the labeling in that chart. TJ.

TJ, can 'flats' be buried within diagonals?

ReplyDeleteYes, as the 'B' wave portions of the zigzags only. TJ.

DeleteGreat reminder. Only the b portion of the ZZ can be a three.

DeleteOnly the b portion of the ZZ can be 'any' three. TJ.

DeleteThanks. Very clarifying.

DeleteThanks TJ, I think Fed decision will be the catalyst to this count May 6-7. Do you think Fed will cut in view of Tariff's increasing inflation? or the markets have already accepted a no cut and go to a new SPX high ?

ReplyDeleteNo. I am not a fortune-teller. I measure waves and determine from the measurements which counts follow the rules. And I reject any count that does not follow the rules. From there I look for a course of action. I have showed two plausible counts above. I personally have no interest in what the FED does or does not do with rates. I don't really even find it interesting. TJ.

DeleteAmen

DeleteWhat's interesting is on the tariff announcement ES made a high and so far spx has not taken it out. It makes sense that will be a decision point of acceptance.

ReplyDeleteES/SPY (CFD) in the overnight CFD, the purple asterix's length has been exceeded lower. This eliminates further continuing contracting diagonals of a kind. Watch to see if the blue one is exceeded lower too, as it would eliminate other contracting diagonals, as well.

ReplyDeletehttps://www.tradingview.com/x/LPK4p0kB/

TJ

Overnight, the purple and the blue lengths were exceeded lower, leaving only the red length at 5,620 as shown. The potential diagonals 'may' have finished in this manner, but I would like to see the 'b' wave exceeded lower as a possible trigger to a head & shoulders.

Deletehttps://www.tradingview.com/x/HOx0ROyZ/

And remember, over all the five waves (v) 'could be' leading and not ending, but room must exist in our thoughts for both.

TJ