In the prior post, we said to track the daily bars for the next day, and if a higher high was not formed above Monday's high, a up (green) fractal would be valid. We had shown this potential fractal and the prior down (red) fractal in the chart in the daily chart that prior post. We said that a break of that down (red) fractal would likely be significant.

A higher high was not made, and so in the simplified Bollinger Band form of the chart, the new daily up (green) fractal is now shown.

|

| ES Futures - Daily - Down (Red) Fractal Broken Lower |

The significance of the down (red) fractal break is that now a back test of that lower daily up trend line shown yesterday has resulted in a back-test failure. Today's up wave failed at the 18-day SMA, and on the SPY 5-minute chart, we detected another truncation which is now proven correct ..by the lower daily low.

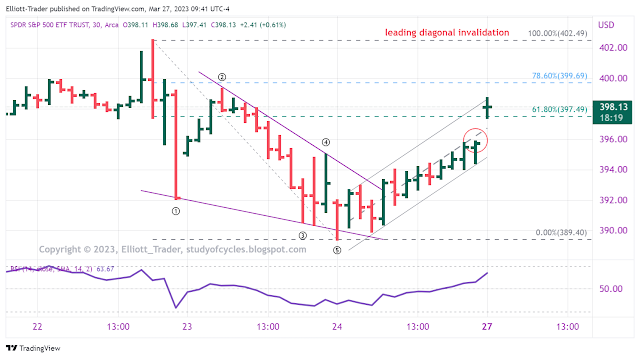

Here is the SPY hourly intraday chart to show you where that new truncation is (red asterisk *).

|

| SPY Cash - Hourly - New Swing Low & Wave Degrees Unfolding in Turn |

As you can see prices are below both the prior hourly sub-minuette wave i, and the prior micro degree wave Ⓑ resulting in the swing failure. This post is titled Miracle Whip? because it is now the bulls that must find a way to get up above the new upper descending channel line and that micro wave ②.

As I have said and written before, no amount of price movement to the downside will surprise me. Extreme upward movement is not impossible, and it would be foolish not to be prepared for a surprise report. However, such is getting less and less likely with every passing day. Currently, the market is tracking degree labeling well. And one must keep in mind that wave threes can expand by simply making smaller and smaller degree waves - a lot of them. Often, this happens in the overnight, so the third waves have time to form gaps.

For the record, I said in response to a previous comment that the "sharp rallies" are a feature of true bear markets. I realize how easy it is for some to get bullish on them. But other features of true bear markets are "failure swings", and truncations. These latter two items are two of the weapons the market uses to keep traders from top-ticking swings. And it makes all scratch their head long enough wondering what "the correct EW count is at the moment" that it stalls entries. We're becoming more used to them, but they are still troublesome for all.

For now, as shown on the chart, be aware that in the local hourly count, there are no gaps in the upward direction from sub-minuette wave ii, down to the current low. That might make it more difficult for those pesky algorithms to set targets in that direction.

In any event tomorrow is the Payroll Employment Report and the response is likely to be fun. Let's see how it goes,

Have a good start to the evening.

TraderJoe

.png)