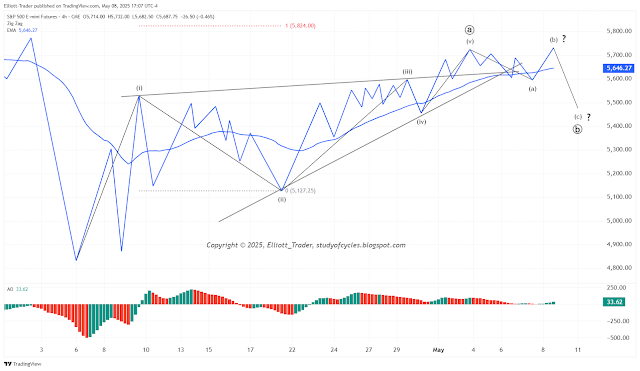

Since Thursday's high in the ES futures, there is about a 65:35% chance that the down movement is only a "three", or an a,b,c lower on the ES 30-min chart, as below.

The length of the b wave being much longer-in-time than entire length of the a wave down seems to mean the two legs should be of the same degree, rather than be an internal fourth wave. Certainly, we counted the c wave down as five-waves-down that started with an expanding diagonal on Friday.

Further, on Friday, we popped the parallel to the upside in what we counted as five-waves-up followed by a flat wave.

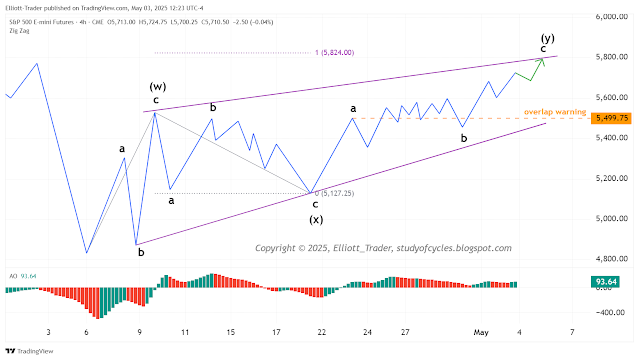

That would seem to make Thursday's cash high a critical marker for the future. If the high of the futures equivalent, the bar that opened at 09:30 ET on Thursday, at 5,956.25 is exceeded higher, it would tend to invalidate any such 1-2 down in the cash market. So, we think if that occurs, some kind of flat or expanded flat might be forming for the Minor B wave lower.

If that level is not exceeded, then it is possible we are going lower by diagonal or multiple zigzags, so this is where patience is really necessary, and we will have to watch and count locally as best we can.

The daily chart, too, looks like yin-yang candles, and this not a very impulsive start if this is the Minor B wave. However, while price is still above the 18-day SMA, the daily slow stochastic is still in over-bought territory and the suggestion is new money would not immediately begin chasing the move.

Over the weekend there was news of possibly taking steel tariffs up to 50%, for which the EU said it might retaliate if that occurs. Monday June 2 is the first trading day of the new month and the inflows from passive investment sources may occur. We shall see.

For now, have an excellent rest of the weekend,

TraderJoe